Daily nowcasting of global and Australian GDP growth1

Now(cast) you’re talking!

Some economic series are published infrequently and with a significant lag; GDP is a prime example. In Australia, it is published on a quarterly basis more than two months after the end of the quarter. Nowcasting2 is a technique that allows a series to be estimated in real-time based on other series which are more frequent and timelier. For example, current quarter GDP could be forecast using a combination of daily, weekly, monthly, and quarterly series. Here, the nowcast could be updated daily (the highest frequency of the data being used to explain GDP) based on the data available to that point in time across all the frequencies assessed.

Nowcasting addresses the challenges posed by the low frequency and delayed nature of some data releases by allowing for forecasts of these series to be updated in real-time in response to incoming information. This is important when economic circumstances are changing rapidly, such as the case at present.3

Method, Man!4

There are dozens, if not hundreds, of indicators that could be used to nowcast GDP growth. To account for as much of this information as possible, I have used a statistical technique to extract the common trends across a range of series. I have then used these trends in a mixed-frequency model to estimate GDP on a daily basis. Such a high frequency has not commonly been used in previous studies5 and is useful as it allows for a very timely assessment of economic conditions. The results of this exercise can be seen in Graphs 1 and 2 below.

Daily nowcasting of global and Australian GDP growth

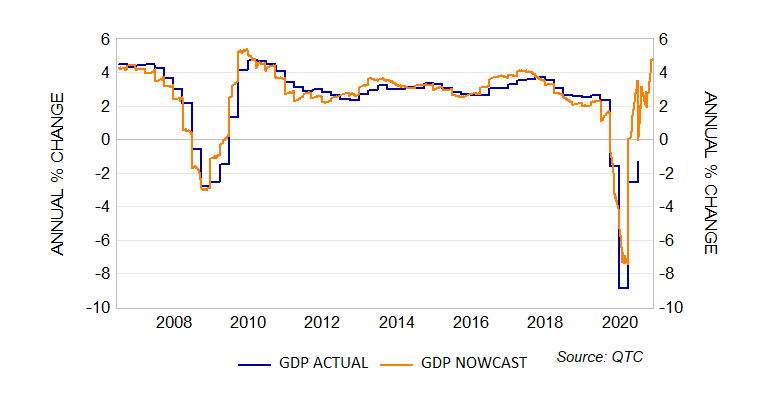

The daily nowcast of global GDP growth (Graph 1) matches actual annual GDP growth (published quarterly) consistently throughout the period examined, including through the global financial crisis and COVID-19 shock.

Graph 1: Global GDP Nowcast

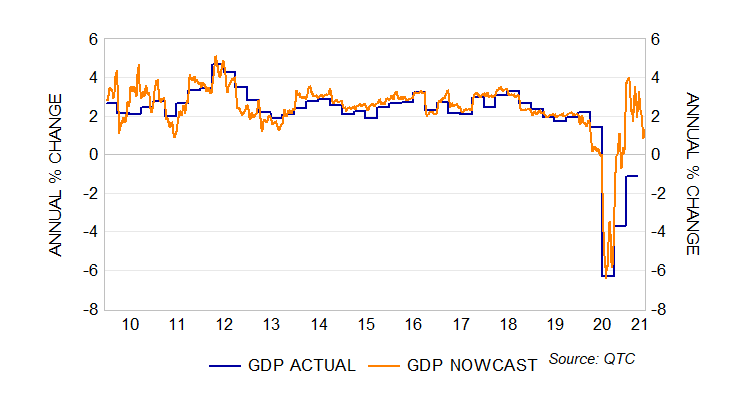

Similarly, the daily nowcast of Australian GDP growth (Graph 2) moves with actual annual GDP growth (published quarterly) reasonably well.

Graph 2: Australian GDP Nowcast

At present, and with estimates up to the current quarter (Q2), the global nowcast suggests that annual GDP growth has held-in at firm rates so far in 2021. Meanwhile, the Australian nowcast indicates that after peaking at the end of 2020, daily nowcasts of annual GDP growth have slowed so far this year.

It should be noted that due to large base effects6, gauging underlying economic momentum based on annual GDP growth rates will be challenging over the coming few quarters.7 The nowcasts presented above have not been adjusted to account for this as these impacts are temporary and should fade as the year progresses.

Discussion

Nowcasting offers the opportunity to conduct real-time assessments of economic activity. It helps give a contemporary sense of potential outcomes for series which are released at a low frequency and with a lag. It is always useful, but arguably more so at turning points in the economic cycle when visibility over what can be significant changes in economic conditions may be low. While base effects might complicate the interpretation of underlying economic momentum in the near term, the nowcasts of global and Australian GDP growth introduced in this note (and outlined in more detail in the technical appendix) provide a useful means for us to track how the recovery is unfolding. These will be further updated and refined over time and presented in our economic research going forward.

To receive an alert when a new article is published, sign up here.