2019-20 Annual Report (text version)

The Queensland Treasury Corporation Annual Report 2019-20 provides details of Queensland Treasury Corporation’s (QTC’s) achievements, outlook, performance and financial position for the 2019-20 financial year.

20 August 2020

The Honourable Cameron Dick

Treasurer, Minister for Infrastructure and Planning

GPO Box 611

Brisbane QLD 4001

Dear Treasurer

I am pleased to present the Annual Report 2019–20 and financial statements for Queensland Treasury Corporation.

I certify that this Annual Report complies with:

- the prescribed requirements of the Financial Accountability Act 2009 and the Financial and Performance Management Standard 2019, and

- the detailed requirements set out in the Annual Report requirements for Queensland Government agencies.

A checklist outlining the annual reporting requirements can be found at page 66 of this Annual Report or accessed at www.qtc.com.au.

Sincerely

Gerard Bradley

Chairman

Queensland Treasury Corporation (QTC) has a statutory responsibility to advance the financial position of the State, and a mandate to manage and minimise financial risk in the public sector and provide value-adding financial solutions to its public sector clients. Established under the Queensland Treasury Corporation Act 1988, QTC is a corporation sole, reporting through the Under Treasurer to the Treasurer and the Queensland Parliament.

VISION

Securing Queensland’s financial success

MISSION

To deliver optimal financial outcomes through sound funding and financial risk management

2019-23 STRATEGIC GOALS

STRATEGIC GOALS

1. State and client value

2. Sustainable funding

3. Organisational excellence

VALUES

CLIENT FOCUS

We build strong partnerships with our clients to deliver simple and well-designed solutions that achieve quality outcomes for Queensland.

TEAM SPIRIT

We work as one team, taking joint responsibility for achieving our vision and collaborating to achieve outstanding performance.

EXCELLENCE

We aim for excellence using flexible and agile processes to continuously improve.

RESPECT

We show respect by recognising contributions, welcoming ideas, acting with honesty, being inclusive and embracing diversity.

INTEGRITY

We inspire trust and confidence in our colleagues, clients, stakeholders and investors by upholding strong professional and ethical standards.

As the Queensland Government’s central financing authority, Queensland Treasury Corporation plays a pivotal role in securing the State’s financial success.

With a focus on whole-of-State outcomes, QTC provides a range of financial services to the State and its public sector entities, including local governments. These services include debt funding and management, cash management facilities and financial risk management advisory services.

Debt funding and management

QTC borrows funds in the domestic and global markets in the most cost-effective manner and in a way that minimises liquidity risk and refinancing risk. QTC achieves significant economies of scale and scope by issuing, managing and administering the State’s debt funding.

QTC works closely with Queensland’s public sector entities to assist them to effectively manage their financial transactions, minimise their financial risks and achieve the best financial solutions for their organisation and the State.

Cash management facilities

QTC assists the State’s public sector entities to make the best use of their surplus cash balances within a conservative risk management framework. QTC offers overnight and fixed-term facilities and a managed cash fund.

Financial risk management advisory services

QTC offers a range of financial risk management advisory services to clients, including:

- support to ensure financial risks are identified and effectively managed

- advice on financial and commercial considerations

- expertise in financial transactions and structures

- project management support to deliver key project outcomes

- collaboration with the financial markets and private sector institutions, and

- public sector financial education programs, delivered in partnership with the University of Queensland.

On behalf of the Queensland Treasury Corporation Capital Markets Board, I am pleased to present the Annual Report 2019–20 on the performance of QTC in an extraordinary year. The economic and social turmoil brought by COVID-19 has been significant and continues to impact economies and communities across the globe. As Queensland’s central financing authority, there has never been a more important time for QTC to provide sound funding and financial risk management for the State.

The State entered the crisis in a strong funding and liquidity position on the foundation of QTC’s established market reputation and bond liquidity, which are underpinned by Queensland’s strong credit rating and State Government Guarantee. Through the successful adaptation of QTC’s funding strategy during the year, QTC raised $20.5 billion in volatile markets to meet the State’s current and future funding needs.

QTC also dedicated significant financial advisory resources to the State’s COVID-19 response and recovery initiatives. With its extensive knowledge of government and financial risk management expertise, QTC provided immediate support to the government’s businesses at a pivotal stage in Queensland’s pandemic response.

Organisationally, QTC’s pre-emptive and considered response to the pandemic provided a seamless transition for staff to work from home, and facilitated the continuous delivery of QTC’s core funding and advisory services. QTC’s strong performance returned a $50 million dividend to Queensland Treasury, which is consistent with previous years and a notable achievement in the current environment.

While QTC’s management and employees are to be commended for their strong contribution to Queensland this year, the wide-ranging and significant fiscal, economic and social impacts of COVID-19 prompted the Board to moderate employee remuneration. This included a reduction in the variable remuneration element of employees’ total compensation for 2019–20 and no general increase in base remuneration for 2020–21.

Membership of the Board changed during the year, with Alison Rayner’s resignation from Queensland Treasury and, therefore, her role on the QTC Board on 12 September 2019. Then, at the end of the financial year and after more than seven years of service, Tonianne Dwyer left the Board. On 16 July, Jim Stening and I were reappointed, and Queensland’s Deputy Under Treasurer, Leon Allen, joined the Board.

On behalf of the Board and management, I wish to thank Alison Rayner and Tonianne Dwyer for their contribution and service to the QTC Board.

QTC’s achievements in the 2019–20 financial year, with the backdrop of market volatility and social restrictions from COVID-19, demonstrated its ability to adapt and deliver the priorities of Government under challenging conditions.

With QTC’s established leadership team and talented employees, I am confident that QTC will continue to provide the funding and financial risk management advice that will support Queensland’s economic growth as it emerges from

COVID-19.

G P BRADLEY

Chairman

20 August 2020

QTC’s critical role in securing Queensland’s financial success has been amplified this year with COVID-19’s impacts on the State’s fiscal and economic position. Despite the most challenging financial markets backdrop our organisation has seen in its 32 year history, we have been able to deliver strong financial results with $300 million of returns to our Queensland Government stakeholders. In addition, QTC made an operating profit of $67 million with a reduction in operating costs of $9.2 million against budget.

QTC’s reputation as a leading semi-government issuer meant that we were able to achieve a record of $20.5 billion issuance, with a significant proportion accessed during severe market volatility. QTC’s ability to achieve this strong performance in 2019–20 has drawn on years of transformational change and investment in systems, risk management and culture. QTC has continued to be recognised in the industry as a corporate leader, this year building on its cultural transformation award with recognition as an ‘Employer of Choice’.

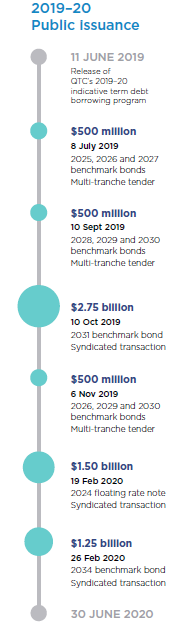

Funding the State

Strong investor demand for QTC’s term debt issuance supported the early completion of Queensland’s $9.9 billion 2019–20 borrowing program. As COVID-19 escalated, QTC continued to demonstrate its reputation as a premium issuer through the high-quality execution of term debt issuance under extremely volatile market conditions—raising an additional $10.6 billion to further strengthen the State’s funding and liquidity position.

In 2019–20, QTC used the flexibility of its balance sheet and liquidity holdings to protect client loans from interest rate volatility and increased costs during the market disruption from COVID-19.

The period before COVID-19 featured an increasing market and investor focus on environmental, social and governance (ESG) factors in investment decisions. QTC and the State are well-positioned to respond to this interest, with an expanded green bond program and Queensland’s commitment to ESG outcomes.

Due to COVID-19, the 2020–21 State Budget has been deferred in line with the Commonwealth and other State Governments. The Queensland Government will publish its COVID-19 Fiscal and Economic Review (C19-FER) in September 2020. The C19-FER will provide detailed forecasts for 2020–21 and the forward estimates. Following its release, QTC will provide a full borrowing program update.

Operating results

In 2019–20, QTC recorded an operating profit after tax from its capital markets operations of $67 million (2018–19: $126 million) and paid a dividend to the State of $50 million. The reduction in operating profit was largely the result of the volatility in financial markets arising from COVID-19. COVID-19 impacted both the market value of the financial instruments held by QTC and presented fewer opportunities to generate returns.

QTC was able to pivot its operations quickly to respond to COVID-19 and reduce its operating costs by $9.2 million against budget for the year, while still delivering major system upgrades and corporate performance goals and objectives.

In addition, QTC’s management of the State’s debt will provide a reduction of $104 million in the market value of Queensland Treasury’s borrowings, equivalent to a 0.06% decrease in the interest rate for 2020–21.

QTC’s Capital Guaranteed Cash Fund delivered $146 million in investment returns to its government clients during the year and retained its position as one of the largest managed cash funds in Australia with $8.6 billion under management. QTC’s Cash Fund was not significantly impacted by the disruptive market conditions in quarters three and four and provided clients with strong returns and security from market volatility.

Over the past five years, the returns from debt management have lowered the State’s costs by a total of $469 million. In addition, QTC’s net earnings have contributed to the payment of $647 million in dividends to the State.

QTC’s retained earnings balance of $527 million, after paying these dividends, demonstrates the organisation’s continued strong financial position. Retained earnings are closely monitored to ensure QTC’s capital requirements are met.

Value delivered for the State

QTC continued to prioritise advisory initiatives that enhance the institutional and financial strength of the State, in partnership with Queensland Treasury and Government clients. QTC completed 49 advisory projects, with 37 still in progress, at no cost to its Government clients. This work delivered cost-savings, economic benefits, fiscal improvements and new sources of revenue for the State.

Highlights during the year included projects to improve health outcomes, develop transport infrastructure, reduce energy costs, grow Queensland’s renewables sector and provide competitively priced internet for regions. In a demonstration of agility, QTC rapidly reallocated almost half of its financial advisory employees to provide vital support to the Queensland Government for its COVID-19 response and recovery initiatives.

Credit ratings

In the year under review, Standard & Poor’s, Moody’s Investors Service and Fitch Ratings reaffirmed Queensland’s and QTC’s credit ratings. QTC is rated AA+/A-1+/Stable, Aa1/P-1/Stable and AA/F1+/Stable by Standard & Poor’s, Moody’s Investors Service and Fitch Ratings respectively. These stable ratings are a key reason for continued demand from domestic and global investors for QTC debt, and for QTC’s ability to exceed borrowing expectations through the COVID-19 period.

Organisational excellence

QTC’s significant investment in leadership, culture and systems over recent years allowed a rapid response to the challenges of COVID-19. A focus on workforce mobility prior to COVID-19 improved the transition to working from home for the majority of staff and enabled uninterrupted delivery of QTC’s core funding and advisory services throughout the year.

QTC was the first institution globally to implement the latest version of its treasury management platform and also upgraded its core finance system, providing continued improvement to its business operations on time and budget.

Independent recognition of QTC’s leadership and culture has continued in 2019–20 and further to the Human Synergistics Culture Transformation Achievement Award, QTC was awarded the ‘Employer of Choice’ Gold Award from Human Resources Director.

Positioned for ongoing success

As QTC emerges from one of the most challenging and rewarding years since its inception, and I am confident our team of highly-skilled experts will continue to provide a meaningful and valuable contribution to Queensland.

P C NOBLE

Chief Executive

20 August 2020

Environmental, social and governance

QTC is committed to environmental, social and governance (ESG) outcomes.

In 2019–20, QTC worked closely with its stakeholders to deliver key ESG initiatives, including:

- providing institutional investors with green investment opportunities

- supporting the Queensland Government to deliver its sustainability initiatives

- enabling ESG reporting of QTC’s Capital Guaranteed Cash Fund, and

- providing organisational contributions that benefit the community.

QTC supported the establishment of a new, publicly-owned, clean energy generation company (CleanCo), which has a strategic portfolio of low and zero emission power generation assets.

CleanCo will provide long-term benefits to the energy market and increase investment in renewable energy.

The Queensland Government, through QTC, donated $100,000 to FareShare as part of ongoing support to help further the establishment of its operations in Queensland. Since QTC’s engagement with FareShare began in early 2019, employees have volunteered at the Brisbane kitchen to prepare 8,233 nutritious meals for vulnerable Queenslanders and used their problem-solving skills to provide solutions to challenges FareShare identified during the establishment of its Queensland business model.

In 2019–20, QTC engaged Morgan Stanley Capital International (MSCI) as its ESG reporting provider to enable future reporting of the Cash Fund’s ESG profile. Several reporting firms were reviewed and MSCI, a globally recognised ESG reporting provider, was selected. QTC also conducted an in-depth analysis of State ESG ratings and underlying methodologies to provide a thorough understanding of Queensland’s ESG rating that is currently published.

QTC continued to attract significant green finance through its expanded Green Bond program. In 2019–20, QTC increased its 2029 green bond line from $1.25 billion to $1.73 billion, being the first Australian semi-government issuer to tap a green bond line using Climate Bonds Initiative (CBI) programmatic certification.

QTC’s Green Bond program supports the Government’s transition to a low-carbon economy and has grown its eligible project pool to approximately $6.3 billion as at 31 December 2019. QTC is currently the largest semi-government Australian dollar, CBI Certified, green bond issuer by volume with $2.48 billion on issue as at 30 June 2020.

Queensland attracts significant green finance investment

QTC was the first Australian semi-government issuer to be recognised in the CBI Annual Green Bond Pioneer Awards as a leader in green finance, for the Largest Subnational Deal of 2019.

Supporting Queensland through the COVID-19 pandemic

QTC has supported the Queensland Government through the COVID-19 crisis this year by strengthening its funding position and pivoting client work to provide immediate support to Queensland Treasury and the Department of the Premier and Cabinet’s health and economic response priorities. QTC attracted direct investments when the markets were severely disrupted, raising additional funding for the potential budget impacts of COVID-19.

When financial markets were severely disrupted at the beginning of March, due to COVID-19, QTC continued to attract direct investments from international and domestic investors. This was underpinned by the State’s strong credit rating, assurance of the State Government Guarantee and liquidity of QTC’s bonds in the secondary market.

QTC was successful in raising a total of $10.6 billion in addition to its $9.9 billion indicative borrowing program, towards future borrowing requirements and additional COVID-19 expenditure.

QTC issued approximately $6.5 billion in a six-week period during severe market volatility, with a distributed workforce and managing increased risk. This included establishing two new non-benchmark bond lines maturing in 2040 and 2041.

QTC’s prudent financial risk management and its ability to attract a diverse investor base has established a strong platform for the future management of the impacts of COVID-19. QTC’s reputation in the market meant that, during a challenging time for funding in global markets, QTC could rapidly strengthen its funding and liquidity position for Queensland’s future requirements.

The Client Division reprioritised its portfolio of projects to provide immediate support to Queensland Treasury and the Department of the Premier and Cabinet in response to the COVID-19 pandemic. QTC enabled the rapid deployment of approximately 50 per cent of advisory staff to the government’s response and recovery initiatives, this included:

- seconding senior staff to the Department of the Premier and Cabinet’s COVID-19 Taskforce

- providing financial analysis support for the Industry Support Package

- supporting the coordination of the Worker Assistance Package

- project office management for rapid 3D printing of protective face masks at Metro North Hospital and Health Service

- providing commercial advice for the Queensland Health Supply Chain and Procurement Taskforce

- analysing consumer spending data analytics for Queensland Treasury to help identify longer-term impacts, and

- assisting the Queensland Rural and Industry Development Authority (QRIDA) Jobs Support Loan Scheme eligibility assessments of small business applications.

Queensland’s health response to COVID-19 has seen it well positioned to deal with the pandemic. The Queensland and Australian Governments have launched a suite of initiatives and stimulus measures to reinvigorate the economy.

QTC provided a rapid response to the workforce challenges from COVID-19. The strength of its core business functions and continuity planning enabled a seamless transition to the government directives for workplaces and individuals. QTC’s planning focused on the health and safety of its employees and continued business operations. QTC activated rapid crisis and contingency plans and deployed organisation-wide communication, remote-working set up and support, new virtual technology, and employee support and wellness programs.

Key outcomes and initiatives included:

- leveraging QTC’s mature and tested business continuity framework to guide decision-making and expand pandemic contingency plans

- establishing new processes and functionality to enable all office-dependent critical tasks to be performed remotely

- transitioning approximately 90 per cent of the workforce to working from home (by mid-March 2020)

- activating an isolated location for a small team to perform critical roles for core funding and transactional functions

- conducting risk assessments to identify and mitigate emerging operational threats and disruptions

- rapidly distributing the technology and equipment needed for remote work

- introducing virtual workshops to enhance staff capabilities in online systems and virtual communication platforms

- developing new employee policies to address a changed work environment

- engaging staff through regular and transparent communication from the executive team

- launching new mobile responsive communication channels to rapidly escalate employee change messages

- recognising flexible behaviours and exceptional contributions, through the Agile Achievers program, and

- supporting employee mental and physical health with weekly wellbeing sessions and walking challenges to encourage a healthy lifestyle.

QTC’s Board and Executive Leadership Team were committed to supporting employees during this period of change through leadership, clear communication and providing the technology, systems and processes for effective remote working.

QTC undertook regular employee pulse surveys in addition to its annual engagement or culture surveys. The strong results indicated that employees felt supported during the crisis, employees felt enabled to work remotely and employees felt positive about leadership and communication.

Creating value for the State and clients

In 2019–20, QTC partnered with Queensland Treasury and its Queensland Government clients to deliver financial, economic and social outcomes to enrich Queensland’s future and economic prosperity. QTC completed 49 advisory projects, with 37 still in progress, at no cost to its government clients. This work delivered cost-savings, economic benefits, fiscal improvements and new sources of revenue for the State. QTC’s strong performance has been achieved through the delivery of financial advisory and project implementation services; and providing high-quality borrowing, cash management and foreign exchange services.

In the year under review, QTC has worked closely with Queensland Treasury and the Department of the Premier and Cabinet to prioritise its advisory initiatives to provide the maximum financial and social outcomes for the State.

In 2019–20, QTC has delivered a broad range of financial advisory assignments for Queensland Treasury and its public-sector clients that address financial risk management issues and assist in making pragmatic business decisions.

QTC supports its clients to implement significant change projects within their own environments and enhance their project delivery capability. In 2019–20, QTC has continued to embed its project delivery methodology with its bespoke project delivery guide—supported by best practice tools and resources. To provide greater long-term outcomes, QTC enhanced its focus on the skills transfer of its project and implementation practices to its government clients.

Significant advice supporting government priorities

QTC focuses on supporting its clients to implement projects that deliver maximum value to the State in terms of risk reduction, increased revenue and cost reduction, and broader social and economic benefits. In the year under review, QTC completed 49 advisory projects, with 37 projects still in progress. The key priority projects that QTC delivered include:

- Cross River Rail: Delivering two significant pieces of work for the Cross River Rail Development Authority covering the investment, development and delivery strategies for the precincts.

- QCN Fibre: Establishing the State’s new government owned business (QCN Fibre) and the contractual arrangements, systems and processes necessary for the business to go live in January 2020. QCN Fibre will deliver economic and social benefits for regional Queenslanders by contributing to faster and more reliable digital connectivity.

- CleanCo: Establishing the State’s renewable energy company (CleanCo), launched on 31 October 2019 to actively trade in the wholesale spot, contract and retail electricity markets. QTC employees were co-located with Queensland Treasury, the Department of Natural Resources, Mines and Energy, and CleanCo to work on project implementation and delivery for CleanCo’s establishment.

- Health: Working with Queensland Health on a sustainability program to meet efficiency and productivity targets, while improving patient outcomes. The first program of work was delivered at the Gold Coast, Sunshine Coast, Children’s Health Queensland, Cairns and Hinterland and West Moreton Hospital and Health Services by establishing project management offices and sustainability optimisation streams.

- Waste Strategy: Working closely with the Department of Environment and Science on the 36 priority projects within the Queensland Waste Strategy. This included an integral project delivery role for the implementation of the Queensland Waste Levy.

The Client Division reprioritised its portfolio of projects to provide resources and immediate support to Queensland Treasury and the Department of the Premier and Cabinet in response to the COVID-19 pandemic. QTC enabled the rapid deployment of approximately 50 per cent of advisory employees to the government’s response and recovery initiatives, this included:

- seconding senior employees to the Department of the Premier and Cabinet’s COVID-19 Taskforce and its strategic economic recovery planning

- providing financial analysis support for the Industry Support Package

- supporting the coordination of the Worker Assistance Package, including stakeholder engagement, and implementation planning

- managing a project office at Metro North Hospital and Health Service for 3D printing of medical equipment

- providing commercial advice and support for the Queensland Health Supply Chain and Procurement Taskforce

- assisting the Queensland Rural and Industry Development Authority (QRIDA) Jobs Support Loan Scheme eligibility assessments of small business applications, and

- assisting Queensland Treasury with the analysis of economic data analytics pre, during and post-COVID-19.

Throughout the year, QTC has worked closely with its local government clients and assisted them to identify and mitigate business risks.

This year, QTC supported a number of regional Queensland councils with business improvement and optimisation reviews with work that included:

- providing a detailed understanding of the costs of the services, key drivers for council’s financial performance and impacts on financial sustainability metrics

- developing business improvement roadmaps for select regional councils to address the key organisational processes that underpin financial sustainability (risk, asset and financial management), and

- working with council to implement the recommendations.

Following the announcement of the Queensland Waste Levy, QTC has worked closely with a number of local governments and regional organisations to promote regional collaboration for local waste and resource recovery strategies. This included assisting councils in tender assessment of waste recovery services to ensure value for money decisions and alignment with the Queensland Waste Strategy and policy setting.

QTC undertook analysis of the economic impacts of the COVID-19 pandemic on the regions. A heatmap was developed showing the most vulnerable local government areas by considering the impacted industries in each region. This information was used by QTC to further understand the risk to the State.

QTC continued to provide low-cost loans and high-performing investment facilities throughout 2019-20.

Debt management

QTC has continued to work closely with Queensland Treasury and its government clients to improve whole-of-state balance sheet outcomes. QTC’s active management of the State’s debt provides a reduction of $104 million in the market value of Queensland Treasury’s borrowings, equivalent to a 0.06% decrease in the interest rate for 2020–21.

In the year under review, QTC has continued to successfully deliver its core mandate of providing clients with a low cost of funds by capturing the significant economies of scale and scope in the issuance, management and administration of the State’s debt. In 2019–20, QTC used the flexibility of its balance sheet and liquidity holdings to protect client loans from interest rate volatility and increased costs during the market disruption from COVID-19.

QTC identified the opportunity to bring forward rebalancing of Portfolio-Linked Loans, due to low market interest rates, to reduce book interest rates and interest costs. QTC has continued to work across its client base to identify strategic opportunities to structure clients’ debt facilities in a way that minimises risk and provides flexibility.

Cash management

QTC offers cash management products that enable its clients to maximise the value of their surplus funds, including Fixed Rate Deposits, a Working Capital Facility and a Capital Guaranteed Cash Fund (the Cash Fund).

In 2019–20, QTC’s Cash Fund provided strong returns and outperformed the Bloomberg AusBond Bank Bill Index by 75 basis points. At the end of the 2019–20 financial year, it remained one of the largest managed funds in Australia with $8.6 billion under management. The Cash Fund continues to offer flexibility by providing clients with quick access to liquidity.

QTC’s Cash Fund was not significantly impacted by the disruptive market conditions in quarters three and four and provided clients with security from market volatility. The Cash Fund was very well positioned ahead of the COVID-19 crisis with 77 per cent of assets maturing under two years, which protected the fund from credit spread widening and provided a high level of liquidity over March and April. QTC’s Cash Fund invests funds in liquid assets and, at year end, 98 per cent of the Cash Fund’s investments were invested in entities rated ‘A’ or higher by Standard & Poor’s.

Throughout the year, QTC continued to meet with clients to provide insights into the Cash Fund’s structure, strategy and performance; and dynamically managed credit and money market positions in a highly volatile market. This enabled proactive repositioning to add value when relative value opportunities arose, particularly during the COVID-19 crisis.

In 2019-20, QTC engaged Morgan Stanley Capital International (MSCI) as its environmental, social and governance (ESG) reporting provider to enable future reporting of the Cash Fund’s ESG profile. Several reporting firms were reviewed and MSCI, a globally recognised ESG reporting provider, was selected. QTC also conducted an in-depth analysis of State ESG ratings and underlying methodologies to provide a thorough understanding of Queensland’s ESG rating that is currently published.

Foreign exchange

QTC’s foreign exchange (FX) services, including its online platform, enable its public sector clients to access wholesale market rates. This year, the FX client base has continued to grow with an increasing number of clients utilising this service. In 2019–20, QTC saved approximately $4 million for the State through its FX services. QTC’s FX transaction volume totalled $233 million. QTC worked with Queensland Treasury on approvals to enable agencies to use dual currency pricing and reduce costs in offshore procurement. QTC has worked with a number of clients to support dual pricing, which has been reflected in the increase in QTC FX transaction volumes.

Education program

QTC provides education services to enhance financial decision-making and support effective engagement with its clients. Since partnering in 2017, the University of Queensland (UQ) facilitates workshops and delivers specialised content across the State. In 2019–20 the education program delivered financial workshops to more than 2,600 participants through a combination of workshops, webinars and think tank events.

Key milestones were achieved through delivering contextualised training programs to Metro North Hospital and Health Service and the Department of Local Government, Racing and Multicultural Affairs (DLGRMA) over the course of the last twelve months. Additionally, through partnership with DLGRMA, a 30-minute overview video on financial literacy was produced for inclusion in the Elected Councillors Induction Training.

To support ongoing development, the education program will implement a pre- and post-workshop platform, which will include digital readings, activities, and video content to engage learners in new subject areas in advance of and post workshop attendance.

| Total Debt Outstanding (Market Value) 30 June 20 A$000 |

Total Debt Outstanding (Market Value) 30 June 19 A$000 |

|

| General Government* | 41 934 014 | 33 192 319 |

| Energy | 27 179 110 | 26 184 078 |

| Water | 15 454 660 | 14 867 575 |

| Local governments | 6 797 068 | 6 302 674 |

| Transport | 5 533 579 | 5 254 122 |

| Education | 860 888 | 829 207 |

| Other | 574 967 | 499 800 |

| Total | 98 334 286 | 87 129 775 |

* General Government includes Queensland Treasury and Arts Queensland.

Achieving sustainable access to funding

QTC’s funding strategy placed the State in a strong funding and liquidity position ahead of COVID-19. After successfully completing its indicative 2019–20 $9.9 billion borrowing program in February 2020, QTC further strengthened the State’s position by raising an additional $10.6 billion to 30 June. As a leading semi-government bond issuer, QTC continued to attract a diversified investor base throughout the market disruption caused by COVID-19.

QTC is a highly-regarded bond issuer in global fixed-income markets and raises the funds needed by the State each year, often ahead of time, with its bond issues consistently over-subscribed.

Prior to COVID-19, QTC was in a strong funding position, having completed its indicative $9.9 billion borrowing program for 2019–20 in February 2020. When markets were severely disrupted in March and April, QTC continued to attract domestic and international investors, seeking to invest in QTC’s State government guaranteed bonds. This enabled QTC to raise an additional $10.6 billion, taking its total gross term debt issuance to approximately $20.5 billion as at 30 June 2020. This placed the State in a strong funding position and increased its liquidity holdings, which support the State’s strong credit rating and provide reserves if market conditions are unfavourable for funding in the future.

QTC’s well-managed funding program and reputation for high-quality debt issuance, means Queensland can access the funds it needs at cost-effective rates. To attract a broad investor base, QTC offers investors a diverse range of high-quality investment options. In the past year, QTC’s funding strategy has included issuing bond maturities out to 30 years, a new AUD floating rate note, and being the first Australian semi-government issuer to enable issuance of Green Bonds through reverse enquiry.

Highlights included:

- issuing approximately $12.5 billion of benchmark bonds, including two new bond lines maturing in 2031 and 2034

- issuing approximately $2.3 billion in long-dated, non-benchmark bonds, including:

- two new bond lines maturing in 2040 and 2041

- EUR55 million of a new Euro medium term note maturing in 2050

- increasing the 2029 Green Bond line to $1.73 billion, and

- issuing $2.3 billion of a new floating rate note maturing in 2024.

On 24 April, QTC released its Green Bond Annual Report. The report discloses information regarding the allocation of proceeds from QTC’s green bond issuances. Proceeds from QTC Green Bonds are allocated against qualifying green projects and assets for the State of Queensland that support Queensland’s transition to a low carbon, climate resilient and environmentally sustainable economy.

QTC’s proactive management of its borrowing program and the management of its client funding and balance sheet activities helped to smooth and extend its maturity profile, reducing its refinancing risk by achieving more evenly-distributed maturities across the curve. This included approximately $1.2 billion in cancellations of 2021 and 2022 maturities and the repayment of the $6.3 billion 2020 maturity from liquidity reserves, with no further debt needed to be issued to fund this maturity.

As a large, active green bond issuer, QTC has continued to support the development of Australia’s green bond market and provide investment opportunities to its domestic and global investor base. It was the first Australian semi-government issuer to tap a green bond line using its Climate Bonds Initiative (CBI) programmatic issuance and to be recognised in the CBI Annual Green Bond Pioneer Awards as a leader in green finance, for the Largest Subnational Deal of 2019. Its Green Bond program supports the Government’s transition to a low-carbon economy and its eligible project pool of approximately $6.3 billion (as at 31 December 2019), enables its ability for future issuance.

QTC continued to focus on activities to expand its investor base, delivering an effective domestic and global investor relationship program during the year. Open and transparent communication with current and future investors on Queensland’s economy and funding program has kept the market fully-informed and remains a focus. QTC continued to regularly engage with both its Fixed Income Distribution Group and investors through its Funding and Markets Division.

As at 30 June 2020

QTC has a diverse range of funding facilities in a variety of markets and currencies. The majority of QTC’s funding is sourced through long-term debt facilities, with QTC’s AUD benchmark bonds being the principal source of funding. As at 30 June 2020, QTC’s total debt outstanding was approximately $99.5 billion.

| OVERVIEW AS AT 30 June 2020 | SIZE (AUDM) | MATURITIES | CURRENCIES | |

| Short-term | Domestic T- Note | Unlimited | 7–365 days | AUD |

| Euro CP | USD10,000 | 1–364 days | Multi-currency | |

| US CP | USD10,000 | 1–270 days | USD | |

| Long-term | AUD Bond | Unlimited | 13 benchmark lines and a range of non-benchmark lines with various maturities* | AUD |

| Euro MTN | USD10,000 | Any maturity subject to market regulations | Multi-currency | |

| US MTN | USD10,000 | 9 months – 30 years | Multi-currency | |

*See QTC’s website for further details of non-benchmark bond lines.

Achieving organisational excellence

QTC is committed to maintaining high organisational standards to provide an environment where corporate goals can be achieved, and organisational risks are actively monitored and addressed.

In a year marked with workplace disruption and challenges from COVID-19, QTC sustained and enhanced its operational excellence to support its core business of managing financial risk for the State. QTC adopted an early response to the pandemic and implemented a distributed workforce arrangement, which was supported by enhanced processes and functionality for roles that were ordinarily office-based.

A sustained focus on the continuous improvement of QTC’s organisational capability has delivered further enhancements to systems, risk management and talent development practices. These improvements have optimised the foundation from which QTC’s core funding and advisory business is delivered. Employees were provided with a strong platform to maximise the delivery of real value to the State under a distributed working arrangement—including managing an increase in bond issuance, risk reporting and client portfolio rebalancing. Due to the continuity of business operations, QTC was also able to lead the implementation of new systems within its desired project timeframes. QTC was the first institution globally to implement the latest version of its treasury management platform and also upgraded its core finance system, providing continued improvement to its business operations on time and budget.

QTC’s agile and effective response to COVID-19 ensured business continuity and the health and safety of employees, while adhering to the government and health guidelines. QTC activated rapid crisis and contingency plans and deployed organisation-wide communication, remote-working set up and support, new virtual technology, and employee support and wellness programs.

QTC manages its risks within an enterprise-wide risk management framework. The framework supports the achievement of QTC’s corporate objectives by providing assurance that QTC’s risks are identified, assessed and adequately and appropriately managed.

QTC produces a risk appetite statement that sets the tone from the top for risk management and establishes clear boundaries in which QTC’s material risks are to be managed.

The framework incorporates key internal controls, and through periodic attestation by control owners, assurance is given to management and the Board that these controls are operating effectively.

The outcome of the 2019–20 internal audit program was positive with 13 internal audits conducted and completed successfully. Of these audits, nine carried a rating of ‘4 out of 5’ and four carried a rating of ‘5 out of 5’, demonstrating a well-controlled environment.

The risk management framework has enabled QTC to identify and prepare for risks including negative rates ahead of RBA quantitative easing, a potential liquidity crisis and increased resilience to cyber threats.

Throughout 2019–20, QTC managed its portfolio market risk exposures, including interest rate, foreign exchange and counterparty risk, within its Board-approved risk management framework. QTC continues to hold a portfolio of diverse, liquid financial securities to meet the State’s liquidity requirements, consistent with policy requirements.

QTC competes with the global financial industry to attract and retain its high calibre employees. Under the Queensland Treasury Corporation Act 1988, QTC employees are hired on individual contracts, with employment practices aligned to the financial markets in which it operates.

QTC’s Board regularly reviews QTC’s remuneration framework, with the total compensation package of employees comprising fixed and variable remuneration components. The reviews are benchmarked against remuneration data from the Financial Institutions Remuneration Group Inc (FIRG) which provides salary survey data for the Australian finance industry. QTC’s variable remuneration element of total compensation provides an opportunity for an annual short-term incentive for eligible employees, designed to ensure market competitiveness and reward outstanding organisational, divisional, group and individual performance. The QTC Board approves the entitlement to, and the quantum of, the annual review of fixed remuneration and variable short-term incentives.

With an articulated commitment to our employees to enable ‘the best work of their careers’, key focus areas in 2019–20 have been on delivering against our leadership and professional development strategies in order to strengthen organisational capability and promote mobility.

Key initiatives included:

- developing a capability framework and supporting tools to guide professional skills development, recruitment and resource allocation

- strengthening the leadership development program through the introduction of leadership competencies articulated in the capability framework

- delivering a senior leadership development program, enabling leaders to build ‘the best version of QTC’

- targeted leadership programs across all levels to develop the capabilities of leaders

- delivering in-house workshops focusing on culture, development, planning and working styles

- continuing to provide on-demand professional development resources via our in-house digital platform

- strategic workforce planning to align to our organisational vision and strategy, while incorporating the consideration of the future of work and impact of automation

- project opportunities embedded within client organisations

- talent management and succession planning programs

- CEO Awards provides non-monetary recognition of individual employees and teams who exemplify QTC’s values, and

- culture and diversity programs.

Through the COVID-19 environment, the key initiatives pivoted to supporting our distributed workforce and maintaining connectivity and engagement. Initiatives during this period included:

- regular connection and communication forums, to enable rapid message dissemination

- virtual workshops, to enhance capabilities in virtual communication platforms, and

- wellness sessions, with a focus on physical, mental and social elements.

QTC continues to grow an inclusive, diverse, flexible and high-performance culture, evidenced by being awarded the ‘Employer of Choice’ Gold Award from Human Resources Director (HRD) in 2020, further to receiving the Human Synergistics ‘Cultural Transformation Achievement’ Award in 2019.

QTC successfully enabled workforce mobility and supported staff through the COVID-19 pandemic via frequent and transparent communication, technical and remote workspace support, and mental, physical and social health initiatives. QTC conducted a number of pulse surveys during the pandemic to assess organisational performance and engagement. Across the surveys there was strong participation with results showing that employees felt positively supported during the crisis.

QTC’s Inclusion and Diversity Strategy recognises that diversity of perspective and experience improves performance, manages risk, and improves decision making. Under the strategy’s three priority streams of culture, family and community, and gender, in 2019–20, QTC:

- continued the Stepping Stone partnership and the intern program with the Australian Network on Disability

- continued its range of mental and physical health programs to support employee wellbeing, including health and fitness checks, ergonomic evaluations, fitness passports and flu vaccinations

- introduced a targeted mental and physical wellbeing program during the COVID-19 pandemic, including weekly virtual mindfulness sessions and step challenges, and

- raised awareness for inclusivity and diversity by supporting Jeans for Genes Day, National Reconciliation Week during NAIDOC Week, World Mental Health Day, FareShare, Australian Network on Disability to sponsor a student internship, RUOK Day and International Women’s Day.

QTC’s policies support flexible and adaptive working. QTC has a range of working arrangements to enable business outcomes and remain responsive and agile. These arrangements supported QTC’s COVID-19 response, with up to 90 per cent of the organisation working off site at any one time.

| Full-time equivalent staff (including fixed-term employees) | 200.9 |

| Permanent retention rate | 88.5% |

| Permanent separation rate | 11.5% |

| Permanent average tenure | 6 years |

QTC was recognised as an employer that provides outstanding initiatives for career growth with learning and development opportunities, recognition programs and an all-encompassing, constructive culture.

Corporate governance

QTC is committed to maintaining high standards of corporate governance to support its strong market reputation, ensure that organisational goals are met, and manage and monitor risks. QTC’s corporate governance practices are continually reviewed and updated in line with industry guidelines and standards.

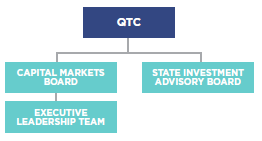

QTC was established by the Queensland Treasury Corporation Act 1988 (the QTC Act) as a corporation sole (ie, a corporation that consists solely of a nominated office holder). The Under Treasurer of Queensland is QTC’s nominated office holder and has delegated QTC’s powers to its two boards:

- the Queensland Treasury Corporation Capital Markets Board (the Board), which was established in 1991 and manages all of QTC’s operations except those relating to certain superannuation and other long-term assets, and

- the State Investment Advisory Board (formerly the Long Term Asset Advisory Board), which was established in July 2008 to manage the State’s long-term assets.

QTC and the Capital Markets Board have agreed the terms and administrative arrangements for the exercise of the powers that have been delegated to the Board by the Under Treasurer as QTC’s corporation sole.

The Board operates in accordance with its charter, which sets out its commitment to various corporate governance principles and standards, the roles and responsibilities of the Board and its members (based on its delegated powers), and the conduct of meetings. The charter provides that the role and functions of the Board are to:

- lead and oversee QTC

- approve the strategic direction and significant strategic initiatives of QTC

- approve Board-owned policies and charters

- oversee organisational culture, values, behaviours and risk

- ensure compliance with relevant legal, tax and regulatory obligations

- approve the annual financial statements and the annual report

- approve the annual administration budget and the total full-time equivalent complement

- approve major contracts and agreements

- approve the Corporate Plan, including the corporate performance measures

- approve the annual assessment of corporate performance and evaluate Board and Board committee performance

- approve the Remuneration Framework, the remuneration pool and short-term incentive targets

- approve the appointment/reappointment/dismissal of the Chief Executive and assess the Chief Executive’s performance against annual performance objectives

- approve the appointment of the internal audit partner and the annual Internal Audit Plan, and oversee the external audit program, and

- oversee the external audit program.

The Board typically holds monthly meetings (except in January, April and September) and may, whenever necessary, hold additional meetings.

Board appointments

The Board comprises members who are appointed by the Governor-in-Council, pursuant to section 10(2) of the QTC Act. Consideration is given to each Board member’s qualifications, experience, skills, strategic ability and commitment to contribute to QTC’s performance and achievement of its corporate objectives. QTC’s Board is constituted entirely of non-executive directors.

Conflict of interest

Board members are required to monitor and disclose any actual or potential conflicts of interest. Unless the Board determines otherwise, a conflicted Board member may not receive any Board papers, attend any meetings or take part in any decisions relating to declared interests.

Performance and remuneration

To ensure continuous improvement and to enhance overall effectiveness, the Board conducts an annual assessment of its performance as a whole. Board members’ remuneration is determined by the Governor-in-Council (details are disclosed in QTC’s financial statements).

Board committees

The Board has established three committees, each with its own charter, to assist it in overseeing and governing various QTC activities. The complete roles and responsibilities of each committee are outlined in the charters available on the QTC website.

Risk and Audit Committee

The Risk and Audit Committee is a decision-making and advisory body responsible for overseeing and assisting the Board with:

- the appropriateness and effectiveness of QTC’s enterprise-wide risk management system (including the enterprise-wide risk management framework, the risk appetite statement, and risk management strategies and policies) and the internal control framework

- risk and risk management, including carriage of the risks attributed to the Risk and Audit Committee

- the effectiveness of internal control processes

- the integrity of the financial statements and associated year-end and interim processes, and

- the adequacy and effectiveness of audit activities.

The Risk and Audit Committee must have at least three members and meet at least four times a year.

During the year, the Risk and Audit Committee recommended the adoption of annual financial statements, reviewed external and internal audit reports and the progress in implementing the recommendations from those reports, and reviewed the Queensland Audit Office’s External Audit Plan and QTC’s Internal Audit Plan.

QTC’s Risk and Audit Committee has observed the terms of its charter and had due regard to Queensland Treasury’s Audit Committee Guidelines.

Human Resources Committee

The Human Resources Committee is a decision-making and advisory body responsible for overseeing and assisting the Board with:

- human resources-related key policies and compliance with relevant legislation

- the framework for remuneration and performance reviews

- the integrity and consistency of QTC’s corporate culture

- succession planning for the executive leadership team, executive development and talent pipeline risks

- strategic workforce planning and operational resource planning, and

- people material risks.

The Human Resources Committee must have at least three members and meet at least three times a year. The Human Resources Committee has observed the terms of its charter.

Funding and Markets Committee

The Funding and Markets Committee is a decision-making and advisory body responsible for overseeing and assisting the Board with:

- funding and markets-related key policies and compliance with relevant legislation

- the alignment of funding and markets activities with QTC’s policies and risk appetite

- QTC’s risk appetite, risk tolerance and risk mitigation strategies for funding and markets activities

- assessing QTC’s ability to access suitable funding markets to meet the State’s borrowing requirements and maintain appropriate levels of liquidity

- liquidity pool performance, and

- Cash Fund and Asset Liability Management Portfolio performance.

The Funding and Markets Committee must have at least three members and meet at least four times a year. The Funding and Markets Committee has observed the terms of its charter.

Meetings held

|

Board |

Risk and Audit Committee |

Funding and Markets Committee | Human Resources Committee | |

| Ordinary meetings held | 9 | 5 | 4 | 4 |

| Gerard Bradley1 | 9 | 1 | 4 | 4 |

| Tonianne Dwyer2 | 9 | – | 3 | 4 |

| Neville Ide | 9 | 5 | 3 | – |

| Anne Parkin | 8 | 5 | – | 4 |

| Alison Rayner3 | 2 | 1 | – | – |

| Karen Smith-Pomeroy | 9 | 5 | – | 4 |

| Jim Stening4 | 8 | – | 4 | – |

1 Mr Bradley’s appointment to the Board expired on 30 June 2020. Mr Bradley was reappointed as Chair of the Board on 16 July 2020 until 30 June 2023.

2 Ms Dwyer’s appointment to the Board expired on 30 June 2020.

3 Ms Rayner resigned from the Board effective 12 September 2019.

4 Mr Stening’s appointment to the Board expired on 30 June 2020. Mr Stening was reappointed as a Board member on 16 July 2020 until 30 June 2023.

The State Investment Advisory Board, formerly named the Long Term Asset Advisory Board, is an advisory Board of Queensland Treasury Corporation established under section 10 of the QTC Act. The Long Term Asset Advisory Board was renamed the State investment Advisory Board (SIAB) on 4 July 2019.

In 2019–20, with power delegated from QTC, the SIAB was responsible for:

- providing governance oversight of the financial assets set aside by the Queensland Government to meet future employee liabilities and other long-term obligations of the State, and

- providing investment governance assistance in connection with the Financial Provisioning Fund established under the Mineral and Energy Resources (Financial Provisioning) Act 2018 and the National Injury Insurance Scheme Fund, Queensland.

The SIAB held four meetings in the year under review.

The SIAB members are appointed by the Governor-in-Council, pursuant to section 10(2) of the QTC Act. The members of the SIAB were:

| Name | Position |

| Rachel Hunter1, Under Treasurer | Chairperson |

| Glenn Miller2, Queensland Treasury | Member |

| Philip Graham3, External Member | Member |

| Maria Wilton3, External Member | Member |

| Tony Hawkins3, External Member | Member |

1 The Chair of SIAB is an ex-officio role. Frankie Carroll was Chair until Rachel Hunter was appointed as the Under Treasurer from 11 May 2020.

2 This position is an ex-officio appointment within Queensland Treasury. Alison Rayner acted as the ex-officio member until 20 September 2019. Following Ms Rayner’s departure, Glenn Miller has acted as the ex-officio member.

3 Mr Graham, Ms Wilton and Mr Hawkins were appointed as members on 4 July 2019. All are external to Queensland Treasury and have specialist experience in investment management and insurance. Philip Noble, Chief Executive QTC and Wayne Cannon, State Actuary ceased to be members on the appointment of the three external members on 4 July 2019.

The SIAB fulfilled its role as identified in its charter during 2019–20.

QTC holds a portfolio of long-term assets that fund the State’s defined benefit superannuation and other long-term obligations. These assets were transferred to QTC by the State under an administrative arrangement in July 2008, for reasons relating to market volatility of the returns. In exchange, QTC issued the State with fixed rate notes set at an interest rate equivalent to the long-term average rate of return for a diversified portfolio of assets.

The long-term assets have no impact on QTC’s capital markets operations and there is no cash flow effect for QTC.

The SIAB sets the portfolio’s investment strategy and has appointed QIC Limited to implement that strategy.

In accordance with the provisions of the Auditor-General Act 2009, the Queensland Audit Office is the external auditor for QTC. The Queensland Audit Office has the responsibility for providing Queensland’s Parliament with assurances as to the adequacy of QTC’s discharge of its financial and administrative obligations.

All significant audit recommendations raised by the Queensland Audit Office during the reporting period were addressed.

The Financial and Performance Management Standard 2019 (Qld) (Standard) governs the operation of QTC’s internal audit function. QTC outsourced its independent internal audit function to EY for the 2019–20 financial year. Internal audit reports to the Risk and Audit Committee and is conducted under an Internal Audit Policy, consistent with the relevant audit and ethical standards. The role of internal audit is to support QTC’s corporate governance framework by providing the Board (through the Risk and Audit Committee) with:

- assurance that QTC has effective, efficient and economical internal controls in place to support the achievement of its objectives, including the management of risk, and

- advice with respect to QTC’s internal controls and business processes.

Internal audit is responsible for:

- developing an annual audit plan, based on the assessment of financial and business risks aligned with QTC’s strategic goals and objectives, as well as material risks, and approved by the Risk and Audit Committee

- providing regular audit reports and periodic program management reports to the management team and the Risk and Audit Committee, and

- working constructively with QTC’s management team to challenge and improve established and proposed practices and to put forward ideas for process improvement.

In the year under review, EY completed its internal audits in accordance with the approved annual audit plan.

QTC has had due regard to Queensland Treasury’s Audit Committee Guidelines, in establishing and supervising its outsourced internal audit function and, together with the Risk and Audit Committee, in overseeing and monitoring the internal audit function.

The responsibility for the day-to-day operation and administration of QTC is delegated by the Board to the Chief Executive and the Executive Leadership Team. The Chief Executive is appointed by the Board and executives are appointed by the Chief Executive. As with the Board, all Executive Leadership Team appointments are made on the basis of qualifications, experience, skills, strategic ability, and commitment to contribute to QTC’s performance and achievement of its corporate objectives.

QTC’s Executive Leadership Team

as at 30 June 2020

| Philip Noble | Chief Executive |

| Grant Bush | Deputy Chief Executive and Managing Director, Funding and Markets |

| Mark Girard | Managing Director, Clients |

| Rupert Haywood | Managing Director, Corporate Services and Chief Risk Officer |

| Jane Keating | Managing Director, Finance, Data and Compliance |

Board members are appointed by the Governor-in-Council, pursuant to section 10(2) of the QTC Act on the recommendation of the Treasurer and in consultation with the Under Treasurer. Members are chosen on their ability and commitment to contribute to QTC’s performance and achievement of its stated objectives.

| Gerard Bradley

BCOM, DIPADVACC, FCA, FCPA, FAICD, FIML Chairman Board Committees

|

Prior to his appointment as the Chair of QTC’s Board, Mr Bradley was the Under Treasurer and Under Secretary of the Queensland Treasury Department, a position he held from 1998 to 2012. He was also a QTC Board member from 2000–2007.

Mr Bradley has extensive experience in public sector finance gained in both the Queensland and South Australian treasury departments. He was Under Treasurer of the South Australian Department of Treasury and Finance from 1996 to 1998, and of Queensland’s Treasury Department from 1995 to 1996. Mr Bradley held various positions in Queensland Treasury from 1976 to 1995, with responsibility for the preparation and management of the State Budget and the fiscal and economic development of Queensland. He is currently a Non-Executive Director and Chairman of Queensland Treasury Holdings Pty Ltd and related companies, a Non-Executive Director of Star Entertainment Group Ltd, Pinnacle Investment Management Group Limited and the Winston Churchill Memorial Trust, a Member of the Queensland regional selection committee for Churchill fellowships, and a Director of the Pinnacle Charitable Foundation and the Pinnacle Compliance Committee. |

| Tonianne Dwyer

BJURIS (HONS), LLB (HONS), GAICD Appointed 14 February 2013. Board Committees

|

Tonianne Dwyer is a lawyer by profession with a career of more than 25 years in international investment banking and finance.

Ms Dwyer’s executive experience covered a broad range of sectors, including real estate investment and development, financial services, health and aged care, education, research and development, and media. She held senior roles with Hambros Bank Limited, Societe Generale and Quintain Estates & Development PLC including a role with the finance division of the UK Department of Health. Over her executive career, she had experience in the UK, Europe and the US. Ms Dwyer currently holds directorships with Metcash Limited, DEXUS Property Group, DEXUS Wholesale Property Fund, ALS Limited and Oz Minerals Limited. She is also a Senator and Deputy Chancellor of the University of Queensland and a Director of Chief Executive Women.

|

| Neville Ide

BBUS (ACCTG), MCOMM (ACCTG and FIN), FCPA, FAICD Appointed 1 October 2018. Board Committees

|

Neville Ide has more than 40 years’ experience in finance and treasury management having held executive roles in the government, finance and banking sectors, including Queensland Treasury Corporation for 12 years and as Group Treasurer at Suncorp Metway Limited.

His industry knowledge and experience covers banking, insurance, infrastructure and corporate treasury management, including debt and equity capital markets, balance sheet structuring and financial risk management. Mr Ide has served as a non-executive director on a number of public and private company boards since 2006, including appointments to Queensland Motorways Limited, RACQ Insurance, RACQ Bank, Retech Technology Limited, SunWater Limited, and as a previous QTC Board member. He is currently a director of QBANK.

|

| Anne Parkin

B SCIENCE (HONS), DIP. ED, GRAG DIP SEC, MBA, MAICD, F FIN Appointed 1 July 2016. Board Committees

|

Anne Parkin has more than 25 years’ of international management and board level experience across Asia-Pacific banking and financial services.

Ms Parkin has held diverse leadership roles in domestic and global broking and banking, superannuation administration, retail management and education in both the public and private sectors. At an executive level, she has experience operating in highly regulated businesses including banking with Credit Suisse and UBS, and in Australian superannuation. Ms Parkin is the former chair of a start up company and a former non-executive director of both Credit Suisse Securities Malaysia and Credit Suisse Securities Philippines. She was also the executive director of the Hong Kong Control Committee, responsible for oversight of operational risk for Credit Suisse Hong Kong and its affiliates, and the executive in charge of operational matters with local regulators, including the Hong Kong Monetary Authority and Hong Kong Securities & Futures Commission.

|

| Karen Smith-Pomeroy

ADIP (ACCOUNTING), Appointed 9 July 2015. Board Committees

|

Karen Smith-Pomeroy is an experienced financial services senior executive with a specialty in risk and governance.

She held senior executive roles with Suncorp Group Limited from 1997 to 2014, including Chief Risk Officer Suncorp Bank from 2009 to 2013, and Executive Director, Suncorp Group subsidiary entities from 2009 to 2014. She has also held positions on a number of Boards and committees including CS Energy Limited and Tarong Energy Corporation Limited. Karen is currently Chair of National Affordable Housing Consortium Limited and the Regional Investment Corporation, and a Non-Executive Director of Stanwell Corporation Limited, InFocus Wealth Management Limited, Infigen Energy Limited and Kina Securities Limited. She is also an Independent Audit Committee Chair of the Queensland Department of Local Government, Racing and Multicultural Affairs; and South Bank Corporation. |

| Jim Stening

DIPFINSERV, FAICD Appointed 13 November 2014. Board Committees

|

Jim Stening has more than 30 years’ experience in financial markets in the fixed income asset class, including hands-on trading and investing in Australian and global capital markets.

Mr Stening has extensive experience in debt markets, business development, executive management and corporate governance across a diverse range of economic cycles. He has held senior roles at NAB, Merrill Lynch and Banco Santander. Mr Stening is the founder and Managing Director of FIIG Securities Limited, Australia’s largest specialist fixed-income firm and a Non-Executive Director of related companies, and a Fellow of the Australian Institute of Company Directors. |

Financial Statements

Financial Statements for the 2019-20 Financial Year (Download pdf, 620Kb)

The foregoing general purpose financial statements have been prepared in accordance with the Financial Accountability Act 2009 and other prescribed requirements.

The Directors draw attention to note 2(a) to the financial statements, which includes a statement of compliance with International Financial Reporting Standards.

We certify that in our opinion:

i. the prescribed requirements for establishing and keeping the accounts have been complied with in all material respects, and

ii. the foregoing annual financial statements have been drawn up so as to present a true and fair view of Queensland Treasury Corporation’s assets and liabilities, financial position and financial performance For the year ended 30 June 2020.

The financial statements are authorised for issue on the date of signing this certificate which is signed in accordance with a resolution of the Capital Markets Board.

G P BRADLEY

Chairman

P C NOBLE

Chief Executive

Brisbane

20 August 2020

Independent Auditor's report

Independent-Auditor’s-Report for the 2019-20 Financial Year (Download pdf, 952 KB)

Appendices

QTC is required to make various disclosures in its Annual Report. QTC is also required to make various disclosures on the Queensland Government’s Open Data website (data.qld.gov.au) in lieu of inclusion in its Annual Report. This appendix sets out those mandatory disclosure statements that are not included elsewhere in the report or made available on the Open Data website.

QTC is committed to providing accessible services to Queensland residents from culturally and linguistically diverse backgrounds. QTC did not receive any requests for interpreters in 2019–20.

Information systems and record keeping

QTC adheres to the Public Records Act 2002 and the General Retention and Disposal Schedule with respect to information and records management.

QTC has enhanced its electronic document and information management systems for improved management of both digital and physical records particularly in relation to expanding cloud technologies. QTC continues to evolve its information security capabilities to protect internally and externally accessible records.

QTC has not experienced any serious breaches and continues to place focus on education, communication and evolving our technical environment to ensure the importance of information and records management remains front-of-mind.

Public Sector Ethics Act

QTC provides the following information pursuant to obligations under section 23 of the Public Sector Ethics Act 1994 (Qld) to report on action taken to comply with certain sections of the Act.

QTC employees are required to comply with QTC’s Code of Conduct for employees, which aligns with the ethics principles and values in the Public Sector Ethics Act 1994 (Qld), as well as the Code of Conduct established by the Australian Financial Markets Association of which QTC is a member. Both codes are available to employees via QTC’s intranet. A copy of QTC’s Code of Conduct can be inspected by contacting QTC’s Human Resources Group (see Appendix D for contact details). Appropriate education and training about the Code of Conduct has been provided to QTC staff.

QTC’s human resource management and corporate governance policies and practices ensure that QTC:

- acts ethically with regard to its Code of Conduct and within appropriate law, policy and convention, and

- addresses the systems and processes necessary for the proper direction and management of its business and affairs.

QTC is committed to:

- observing high standards of integrity and fair-dealing in the conduct of its business, and

- acting with due care, diligence and skill.

QTC’s Compliance Policy requires that QTC and all employees comply with the letter and the spirit of all relevant laws and regulations, industry standards, and relevant government policies, as well as QTC’s own policies and procedures.

Human Rights Act

QTC has updated its strategic and operational plans in line with the objectives of the Human Rights Act 2019 (the Act). These updates are necessary to ensure QTC is respecting, protecting and promoting human rights in decision making and actions.

The Act requires QTC to consider human rights when performing functions of a public nature and only limit human rights after careful consideration. Over the course of the 2019–20 financial year, QTC has conducted a review of its internal policies and practices to ensure its compliance with the Act, as guided by external advice.

Remuneration: Board and Committee

For the year ending 30 June 2020, the remuneration and committee fees of the QTC Capital Market Board members (excluding superannuation contributions and non-monetary benefits) were as follows:

| Board | Committee | ||

| Chairperson | $102,915 | Chairperson | $6,658 |

| Member | $33,551 | Member | $5,152 |

The total remuneration payments made to the members of the QTC Capital Markets Board was $360,781 and the total on-costs (including travel, accommodation, car parking and professional memberships for members) was $17,027.

For the year ending 30 June 2020, the remuneration and committee fees of the QTC State Investment Advisory Board members (excluding superannuation contributions and non-monetary benefits) were as follows:

| Board | |

| Member | $33,551 |

The total remuneration payments made to the members of the QTC State Investment Advisory Board was $110,215 and the total on-costs (including travel, accommodation, car parking and professional memberships for members) was $4,480.

Related entities

The related entities in Note 23 are not equity accounted in the financial report of the Queensland Treasury Corporation. These entities are consolidated into Queensland Treasury’s financial report.

Australian Government Guarantee (AGG): Also known as the Commonwealth Government Guarantee. In response to the global financial crisis, on 25 March 2009, the Australian Government provided a time-limited, voluntary guarantee over existing and new Australian state and territory government borrowing. On 16 June 2009, the Queensland Government took up the guarantee on all existing QTC AUD denominated benchmark bond lines (global and domestic) with a maturity date of between 12 months and 180 months (1–15 years). The RBA approved QTC’s application on 11 December 2009. The AGG was withdrawn for new borrowings after 31 December 2010. QTC has one remaining bond that carries the guarantee of the Australian Government.

Basis point: One hundredth of one per cent (0.01 per cent).

Bond: A financial instrument where the borrower agrees to pay the investor a rate of interest for a fixed period of time. A typical bond will involve regular interest payments and a return of principal at maturity.

Commonwealth Government Guarantee (CGG): See Australian Government Guarantee above.

CP (commercial paper): A short-term money market instrument issued at a discount with the full face value repaid at maturity. CP can be issued in various currencies with a term to maturity of less than one year.

Credit rating: Measures a borrower’s creditworthiness and provides an international framework for comparing the credit quality of issuers and rated debt securities. Rating agencies allocate three kinds of ratings: issuer credit ratings, long-term debt and short-term debt. Issuer credit ratings are among the most widely watched. They measure the creditworthiness of the borrower including its capacity and willingness to meet financial obligations.

Fixed Income Distribution Group: A group of financial intermediaries who market and make prices in QTC’s debt instruments.

Floating rate notes (FRNs): A debt instrument which pays a variable rate of interest (coupon) at specified dates over the term of the debt, as well as repaying the principal at the maturity date. The floating rate is usually a money market reference rate, such as BBSW, plus a fixed margin. Typically the interest is paid quarterly or monthly.

GOC: Government-owned Corporation.

Green Bonds: QTC green bonds on issue are guaranteed by the Queensland State Government, issued under the AUD Bond Program with 144A capability and certified by the Climate Bonds Initiative (CBI). Proceeds from QTC green bonds are allocated to qualifying green projects and assets for the State of Queensland that support Queensland’s transition to a low-carbon, climate resilient and environmentally sustainable economy. QTC’s Green Bond Framework facilitates the issuance of both CBI certified green bonds and green bonds that accord with the International Capital Market Association (ICMA) Green Bond Principles. QTC’s Green Bond Framework has been developed in line with the Green Bond Principles and is consistent with the Climate Bonds Standard. It has been verified by DNV GL, an approved third-party assurance provider that also provides annual verification of QTC’s pool of eligible projects and assets.

Issue price: The price at which a new security is issued in the primary market.

Liquid: Markets or instruments are described as being liquid, and having depth, if there are enough buyers and sellers to absorb sudden shifts in supply and demand without price distortions.

Market value: The price at which an instrument can be purchased or sold in the current market.

MTN (Medium-Term Note): A financial debt instrument that can be structured to meet an investor’s requirements in regards to interest rate basis, currency and maturity. MTNs usually have maturities between nine months and 30 years.

QTC: Queensland Treasury Corporation.

RBA: Reserve Bank of Australia.

T-Note (Treasury Note): A short-term money market instrument issued at a discount with the full face value repaid at maturity. T-Notes are issued in Australian dollars with a term to maturity of less than one year.

| SUMMARY OF REQUIREMENT | BASIS FOR REQUIREMENT | ANNUAL REPORT REFERENCE | |

| LETTER OF COMPLIANCE | A letter of compliance from the accountable officer or statutory body to the relevant Minister/s | ARRs – section 7 | Page 1 |

| ACCESSIBILITY | Table of contents | ARRs – section 9.1 | Inside front cover |

| Glossary | ARRs – section 9.1 | Appendix B | |