History - 1993-1996

Expanding economies of scope

Building on its success in delivering value to clients from its debt funding economies of scale, QTC broadened its capabilities and established an independent corporate advisory service in 1994. Introducing these complementary services allowed QTC to achieve economies of scope in the provision of quality, objective financial and risk management advice.

QTC’s financial expertise was sought across a range of major infrastructure projects. The organisation played a key role in negotiating the merger of Suncorp, the Queensland Industry and Development Corporation, and Metway Bank, joining public and private corporations and bringing them into public ownership. QTC was also engaged to undertake major funding initiatives, including the cross border lease for Stanwell Corporation Limited’s turbines—the largest cross border lease ever undertaken at the time.

The foundations of this client-centric approach to its operations have continued to this day and are reflected in QTC’s mission, values and objectives. By working with its clients and understanding their needs, QTC enhances its product and service offerings, moving beyond simple debt issuance to meet the specific financial requirements of clients in a tailored way. QTC has provided advice, in some capacity, on many of the State’s key infrastructure projects, with its independent insight and analysis a critical component in the management of the State’s financial risk.

Back to topAdding client value: a new mission statement

Since its inception, QTC had made ongoing progress in improving its services to clients and improving the efficiency and effectiveness of its fund raising and liability management strategies. As it grew and developed, QTC’s technical expertise, particularly in the management of client financing arrangements, became a particular strength. This expertise was soon highly sought after by the Queensland Government sector. QTC found itself building a reputation as an accomplished manager of liquidity and financial risk, with its services more in demand than ever before.

With its role changing since its transition to an autonomous and accountable central financing authority, QTC extended its focus to deliver a wider range of financial products and services to the Queensland public sector. The impact of structural changes and reforms such as the National Competition Policy, industry deregulation, restructures and privatisations, and the continued demand for publicly-funded services and infrastructure created a stronger emphasis on QTC’s role as the Queensland public sector’s corporate treasury. Increasingly, QTC’s clients were seeking new, more sophisticated and more effective solutions to meet the financial issues created by those demands.

As QTC grew from focusing solely on its funding operations, to developing a client-service-driven culture with a range of products and services aimed at meeting the needs of Queensland’s public sector, it quickly recognised the need for a more client-centric approach to its business. With its clients’ needs changing, in the 1992-93 financial year QTC developed new structures to meet the changing needs and expectations of these clients and provide them with independent corporate advisory services. These new structures allowed it to construct more individualised facilities, and enabled the organisation to place the delivery of client value on an equal footing with its high quality technical financial expertise.

The new client services program, which began on 1 July 1993, maintained QTC’s existing benefits for clients while providing the flexibility for clients to tailor their funding facilities to meet more specifically their liability management needs. A new range of debt pools was introduced, with the multiple pool structure (one or more of four common debt pools) meeting the changing needs and expectations of clients and allowing them to achieve the debt profile and interest rate exposure most appropriate to their business needs.

In the 1995-96 financial year, QTC reconsidered its strategic approach and embraced a client loyalty operating model. This developed after recognising that while QTC’s technical and financial expertise had achieved economies of scale and scope for its clients, the clients’ interactions with QTC could improve. This new major strategic direction was introduced to focus QTC’s resources on client service delivery and the development of client relationships.

To endorse its commitment to client services, a new mission statement and organisational structure were introduced to enable QTC to deliver value to its customers. This focused on forming strong and effective partnerships with QTC’s clients, to provide excellence in all aspects of these relationships.

Greater flexibility for clients was also provided through the expansion of the debt pool structure to five generic pools, to accompany its highly structured and specialised financing facilities and an increased capacity to offer corporate policy and advisory services.

This new strategic approach, with its underlying shift in both philosophy and operations, represented one of the most significant reforms undertaken by QTC to date. QTC moved to ensure all its clients had access to appropriate skills and information to help them effectively manage their financial risks, to become a financial services provider that continually adds value and provides benefits to all its clients. Feedback from clients indicated this fundamental shift in service provision greatly assisted in strengthening communication and understanding to enhance QTC’s role in tailoring financial solutions that add value to its clients’ businesses.

Client value continues at the forefront of QTC’s operations to this day. QTC strives to deliver the best possible outcomes for Queensland’s public sector, supporting and developing long-lasting and trusting relationships with its colleagues, clients and investors, to create and deliver unique and relevant value as partners in financial solutions.

Back to topMerging Suncorp, QIDC and Metway Bank

In 1996, the Queensland Government sought the assistance of QTC to undertake a review and provide recommendations on future strategies for managing its exposure to the wholly Government-owned Suncorp and the Queensland Industry Development Corporation (QIDC), which were established to service areas that were perceived to be under-serviced at a time when the financial markets were highly regulated and State-based.

Based on the advice provided, the Government approved the merger of Suncorp and QIDC with the publicly listed company Metway Bank to create a new ASX listed, financial institution—Suncorp Metway. The merger of the three companies created a more competitive financial institution, which was better geared to meet the needs of the future.

QTC’s technical skills and expertise were a critical component of the success of this merger, with its advisory services coming into the fore. Our ability to provide valuable and independent insight and analysis for this project was a key component of the success of this transaction. QTC provided Suncorp Metway with its initial core financing requirements—a $1 billion working capital facility and tier one capital subordinated debt facility to satisfy prudential regulatory requirements for the newly listed entity.

Over the course of its development, QTC has continued to assist its clients in achieving the best financial solution for their organisation and the State. We encourage our major stakeholder, Queensland Treasury Department, to use our expertise as an extension of its resources in the analysis of financial and commercial policy relating to the State and its entities.

Back to topEnhanced and client-specific funding models and debt pools

QTC’s commitment to its clients continued with the establishment of client-specific funding models and debt pools. This represented a significant innovation and major point of difference between Queensland and the rest of Australia’s governmental financial community. Where other states operated on a back-to-back lending model, and subsequently became driven by the transactions necessary to maintain this practice, QTC adopted a model that enabled QTC to more effectively manage its borrowing and onlending activities in response to the dynamic conditions of the marketplace.

Acknowledging that most clients were primarily concerned with the cost of their financing and associated refinancing risk over time, QTC designed a pool structure that would reduce these risks and overcome the problem of declining duration. Ultimately offering a set of debt pools that catered to three, six, nine, 12 and 15 year terms, along with a short-term 50 day floating rate pool, QTC was able to reduce administrative costs for its clients by providing them with one loan facility, rather than a multitude of individual loans.

While the generic debt pool structure proved attractive to smaller clients, the specific infrastructure needs of QTC’s larger borrowing clients like Queensland Rail and the various electricity authorities warranted a more tailored approach. Using the same model as the generic debt pools, QTC began offering individually designed pools with client-specific capabilities that allowed the client to avoid the prohibitive costs of back-to-back liabilities. This approach ensured QTC could deliver value to its clients and respond to the dynamic environment in which they operated to offer innovative and flexible approaches to their financing requirements.

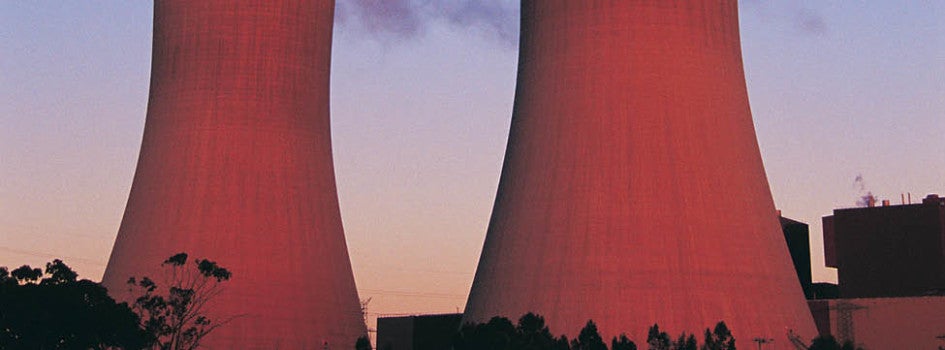

Back to topThe cross border lease

In 1995, QTC facilitated a cross border lease of the turbines at the Stanwell Power Station near Rockhampton, Queensland. The lease involved Stanwell selling the turbines to several investors and taking out a long-term lease of the power station. Under the arrangements, there was an upfront financial benefit for the Government, while Stanwell retained use and control of the turbines. With a transaction size of $1.365 billion, this was, at the time, considered the largest cross border lease ever undertaken, generating a benefit to the State of $94 million.

In the 1995-96 financial year, QTC also acted for the State Government and Queensland Rail in completing a number of cross border lease financings of rail rolling stock assets.

In December 2000, QTC facilitated a cross border lease of the electricity transmission assets of Powerlink. The lease involved US investors purchasing Powerlink’s electricity transmission grid and taking out a long term lease over the assets. The transaction provided a benefit to Queensland of $66 million with a total transaction size of $2.4 billion and was the largest cross border lease undertaken by the State.

While the development of lease-in/lease-out practices, and the growing risks and complex transaction processes associated with cross border leasing, effectively outmoded the use of cross border leases, QTC’s financial expertise and management of these financial tools delivered financial benefits to the State by unlocking value in the respective leased assets. These substantial savings reflected QTC’s approach to seek out the best funding solutions that represent value and savings, benefiting the State of Queensland as a whole.

Back to topManaging people and information

QTC’s new client-focused model provided the drive for innovative changes in systems and processes within the organisation. To achieve its objectives in providing advanced client services, QTC recognised that an appropriate sophistication in information technology would be required to manage information and knowledge flows within the business and between the organisation and its clients and partners.

With this in mind, QTC began investing in advanced information technology systems based on best-practice methodologies. By adopting an open approach and philosophy to its information management processes, QTC was able to better partner with its clients and investors to deliver quality financial solutions. QTC’s practices were based on the capture and sharing of knowledge freely across the organisation and between its partners, to better understand its clients’ concerns and foster a collaborative approach to developing and delivering solutions.

Mirroring its approach to its client and investor partners, QTC also fostered a culture of information sharing and transparency in its internal business operations. This enabled all employees to share information and collaborate, and aided QTC to become a central store of knowledge, experience and expertise on lending and investment activities, financial structures and transactions, as well as the risks and benefits they encompass.

Back to topMarket relationship program

As part of its information sharing philosophy, QTC actively pursued its market relationship activities and developed a proactive, ongoing program to keep its intermediaries and investors fully informed of issues relevant to Queensland and QTC. This was designed to maintain and enhance the State’s and QTC’s reputation in both the domestic and offshore markets, by regularly updating institutional investors and distribution group members on the State’s financial and economic position, as well as our funding facilities and intentions.

These regular meetings and forums also provided a valuable opportunity for intermediaries and investors to express their views and provide advice and feedback on market requirements, allowing QTC to incorporate these suggestions in its funding facilities and operating guidelines, where appropriate.

Today, QTC continues its market and investor relations program, with Queensland Government and QTC representatives conducting a range of financial intermediary and investor meetings across the globe. Our long-established model of direct engagement with investors and market counterparties through initiatives such as the roadshow program, fixed income distribution group conferences and global central banks conferences underpins our success in completing our borrowing program, year after year.

Back to top