2024-25 Annual Report (text version)

The Queensland Treasury Corporation Annual Report 2024-25 provides details of Queensland Treasury Corporation’s (QTC’s) achievements, outlook, performance and financial position for the 2024-25 financial year.

12 September 2025

The Honourable David Janetzki MP

Treasurer, Minister for Energy and Minister for Home Ownership

GPO Box 611

Brisbane QLD 4001

Dear Treasurer

I am pleased to submit for presentation to the Parliament the Annual Report 2024-25 and financial statements for Queensland Treasury Corporation.

I certify that this Annual Report complies with:

- the prescribed requirements of the Financial Accountability Act 2009 and the Financial and Performance Management Standard 2019, and

- the detailed requirements set out in the Annual Report requirements for Queensland Government agencies.

A checklist outlining the annual reporting requirements can be found on page 70 of this Annual Report.

Yours sincerely

Damien Frawley

Chair

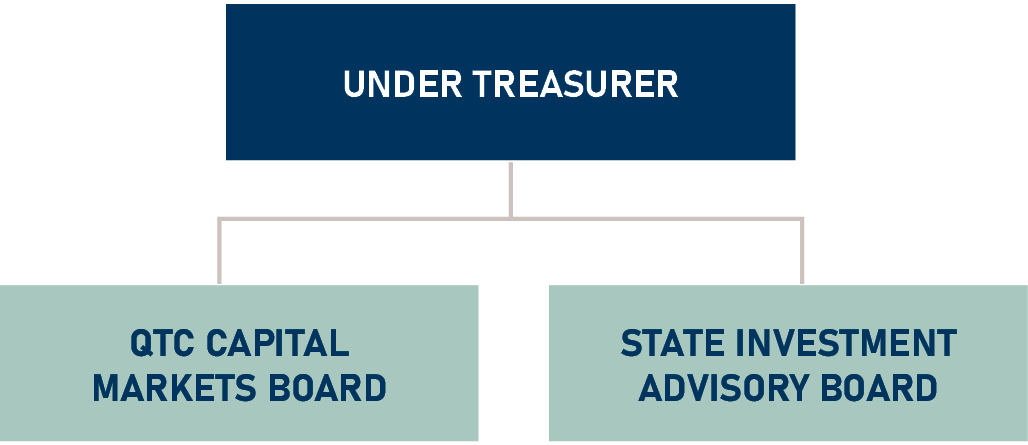

Queensland Treasury Corporation (QTC) has a statutory responsibility to advance the financial position of the State. It also manages and minimises financial risks in the Queensland public sector. Established under the Queensland Treasury Corporation Act 1988 (QTC Act), QTC is a corporation sole, reporting through the Under Treasurer to the Treasurer and the Queensland Parliament.

Purpose

We create value for all Queenslanders through our trusted financial expertise

Vision

Protecting and advancing Queensland’s financial interests1

Values

- Integrity

- Accountability

- Growth

Strategic Pillars

Client Centricity

Our clients’ goals, as reflected in government priorities, are at the heart of all we do.

Great Place to Work

We are focused on our people and creating great leaders.

Risk Mindset

We embrace risk management as a driver of change and continuous improvement.

Creating Value for Queensland

We prioritise Queenslanders’ economic and social outcomes in our work.

Innovation and Excellence

We leverage our creativity and technology and look for ways to innovate and improve.

1Note: QTC’s vision has changed effective 1 July 2025. Refer to Chair’s report on page 5.

At QTC, we are committed to protecting and advancing the financial interests of Queensland.

QTC is the central financing authority for the Queensland Government and provides financial resources and services for the State. We manage the State’s funding program in the global capital markets to deliver sustainable and cost-effective borrowings for the Queensland Government— principally through Queensland Treasury. Our clients also include Government Owned Corporations, departments, agencies, local governments, and other entities such as universities.

With a statutory role to advance the financial interests and development of the State, we work closely with Queensland Treasury and other clients to deliver financial, economic and social outcomes. This includes the development of innovative, long-term solutions that contribute to the growth of Queensland’s economy.

We protect Queensland’s financial interests and deliver better financial outcomes by centralising the management of our clients’ borrowings, cash investments, and financial risks. We also work closely with our clients on their financial exposures, to identify opportunities to minimise costs and risks, and maximise outcomes.

On behalf of the Queensland Treasury Corporation (QTC) Capital Markets Board, I am pleased to present QTC’s Annual Report for 2024-25, marking another significant year of creating value for Queensland.

During the period, QTC consolidated and built on key strategic initiatives across the organisation.

QTC’s Executive Leadership team led a focus on advancing Queensland’s financial interests and delivering positive social and economic outcomes for the State. Through their direction we’ve innovated, and enhanced our services for clients while maintaining a strong risk mindset across the business.

As the Queensland Government’s central financing authority, QTC continued to support the State’s growth and prosperity by delivering cost-effective borrowings through an established funding program and strong investor relationships. This included completing the State’s $26.9 billion 2024-25 indicative term debt borrowing program ahead of schedule, with an additional $2.6 billion raised towards the 2025-26 program.

QTC’s dedicated advisory function continued to work in partnership with clients to solve complex issues aligned with government’s priorities. As their primary lender, QTC also worked closely with Queensland Government Owned Corporations and local governments, providing financial and risk management advice and services. QTC’s Public Education Program delivered targeted financial education programs for public sector clients, further enhancing capability outcomes for Queensland.

Over the period, we welcomed Paul Williams, Under Treasurer, as the Board’s new Queensland Treasury representative. QTC was also pleased to welcome Simon Ling to the role of Chief Executive Officer (CEO) on 30 June. The Board is confident that Simon’s leadership will enable QTC to effectively capitalise on the significant financial opportunities that lie ahead for Queensland.

Simon’s appointment followed the resignation of former CEO Leon Allen. QTC extends its sincere thanks to Mr Allen for his significant contribution and service to QTC. I’d also like to acknowledge Susan Buckley’s contribution as acting CEO from February 2025 until Simon’s commencement.

As we look ahead to the 2025-26 performance year, there are a number of exciting opportunities for QTC to continue to create value for Queensland. From 1 July 2025, Queensland Government Consulting Services (QGCS) was established as a new division within QTC. QGCS will support a broader ongoing government focus on managing expenditure on external consultants and building greater internal capability in the public sector.

Effective 1 July 2025, the QTC Board approved a change to QTC’s vision: ‘to be a world-class financial partner of government’. This updated vision reflects QTC’s significant evolution in global capital markets and the deepening sophistication of its advisory capabilities, including the establishment of QGCS. By aspiring to be ‘world-class’, QTC affirms its commitment to excellence and its intention to benchmark performance and impact against leading international and domestic standards.

I look forward to working with my fellow Board members and the Executive Leadership team on QTC’s continued success.

D J FRAWLEY

Chair

25 August 2025

During the 2024–25 financial year, QTC’s operating environment continued to present challenging economic and market conditions, with ongoing volatility in bond markets.

Despite challenging conditions, QTC completed the State’s $26.9 billion 2024-25 indicative term debt borrowing program on 13 May 2025 ahead of schedule, and raised an additional $2.6 billion towards the 2025-26 program. In doing so, QTC continued to deliver enhanced financial outcomes for the State through cost-effective borrowing, financial risk management, on-lending and cash management.

In 2024–25, QTC supported Queensland Treasury and other key clients to create value for Queensland. This work contributed to fiscal, economic and social benefits and more informed decision-making to enhance Queensland’s prosperity. QTC focused on supporting the government on a range of a key priority areas including energy, infrastructure, investment, housing and social services.

QTC’s strong risk management and operational capabilities enabled it to effectively navigate complex market conditions while protecting and advancing Queensland’s financial interests.

Funding outcomes

As an established bond issuer in global fixed-income markets, QTC continued to raise the funds needed by the State during the year.

QTC’s well-managed funding program and reputation for high-quality debt issuance enabled Queensland to attract a broad and diverse investor base—including many new investors—to secure the necessary funds at cost-effective rates.

To support this, QTC offered a wide range of high-quality financial securities aligned with investor needs. A diversified investor base was further supported by the establishment of four new bond lines.

During the period, Queensland became the first state to publicly issue a euro currency benchmark bond, following QTC’s issuance of a new EUR1.25 billion (~AUD2.15 billion) benchmark bond in May 2025. The issuance received significant demand, with orders more than seven times the issuance amount. Issuing in non-Australian dollars has been an important evolution in QTC’s long-term funding strategy and aligns with our strategic goal to diversify and expand our investor base.

In 2024–25, QTC maintained the State’s strong liquidity position, which supported the State’s credit rating and provided reserves during periods of market volatility.

Operating results

QTC reported an operating profit after tax from its capital markets operations of $126.6 million (2023–24: $166.8 million profit after tax). This outcome was supported by effective liquidity management, which generated a positive 38 basis points in net returns. Expenditure was also closely managed within approved limits.

In 2024–25, the Cash Fund delivered strong relative returns and outperformed the Bloomberg AusBond Bank Bill Index by 65 basis points. At 30 June 2025, funds under management were $11.35 billion. The Cash Fund was underpinned by the quality of the investments, with 100 per cent of the Cash Fund investments having a long-term rating of ‘A-’ or higher by S&P Global Ratings as at 30 June 2025.

Value delivered for the State

QTC collaborated closely with Queensland Treasury to deliver a program of work aimed at creating value and driving positive social and financial outcomes for Queensland. Key contributions included providing financial and risk advice on major government initiatives, supporting the coordinated management of the whole-of-government capital program, and assisting with housing-related strategies.

QTC delivered a wide range of financial advisory services across government entities, supporting sound investment decisions, risk management, and improved efficiencies to drive broader social and economic outcomes. Key highlights included advising Government Owned Corporations (GOCs) on financial performance and risk, contributing to Queensland’s energy system through market analysis, and supporting local government financial sustainability through funding, treasury services, and education.

In 2024–25, QTC enhanced financial decision-making across the Queensland public sector by delivering financial education programs. Through its Open Enrolment Program and tailored agency-specific training, QTC reached a broad audience on key financial literacy topics, while its webinar series provided valuable insights into economic trends for both new and returning learners.

Environmental, social and governance commitment

In 2024–25, QTC advanced key Environmental, Social and Governance (ESG) initiatives including the expansion of green bond investment opportunities for investors, enabling trading carbon offset capabilities, and contributing to government-led ESG outcomes.

Since the inauguration of QTC’s Green Bond Program in 2017, QTC has contributed to the ongoing development of Australia’s sustainable finance market. As at 30 June 2025, QTC remained the largest Australian dollar green bond issuer with total outstanding across five green bond lines of approximately $13.1 billion at face value*.

QTC continues to support Queensland’s energy transition through its work with the energy GOCs regarding strategic performance reviews, borrowing assessments, credit reviews and funding advice. QTC supported the government in the analysis of initiatives that support the energy transition and pathway to net zero emissions. QTC also worked closely with its clients on initiatives that supported social outcomes for the State, including projects to assist the Queensland Government to address challenges to meet the housing needs of Queenslanders and build solutions for regional local governments.

Operational excellence

In 2024-25, QTC enhanced operational performance by implementing key strategies in technology, change, people, and diversity.

In the year under review, QTC settled $430 billion in transaction volume with zero cost of errors. The focus remained on automating processes, improving data quality, and maintaining system currency.

During the period, QTC launched its Data and Technology Strategy 2025-29. Developed collaboratively with stakeholders from all QTC business units, the strategy provides clear guidance to enhance the organisation’s agility to leverage new and emerging technologies while effectively managing associated risks.

QTC’s 2024-25 change portfolio represented the corporation’s most significant focus in uplifting business and technology capabilities since 2016. Change activities were delivered by cross-functional teams from across QTC, providing substantial business benefit including strengthening our cyber posture, building robust technology and data capabilities, and improving the experiences of our clients, investors and employees.

QTC launched its People Strategy 2025-29, outlining a four-year focus on enabling QTC to be a great place to work. The strategy makes organisational commitments to culture, leadership, talent and careers, and QTC’s employment offering. It also recognises the foundational roles of operational excellence, organisational architecture, compliance, systems and internal communications. The strategy will be implemented through annual programs of work reflecting QTC’s progress and growing organisational maturity.

Effective risk management remains a core business priority at QTC, with a proactive approach taken to identify and mitigate risks. QTC managed its portfolio market risk exposures within policy frameworks and approved limits throughout 2024-25, and continued to hold a portfolio of diverse financial securities that met the State’s liquidity requirements.

Looking ahead

As Queensland’s central financing authority, QTC remains focused on adapting to a dynamic external environment and evolving client needs. Our purpose—to create value for all Queenslanders through trusted financial expertise—continues to guide our enterprise-wide improvement initiatives and underpins our new vision: to be a world-class financial partner of government.

This vision reflects QTC’s evolution in global capital markets and the maturity of its advisory capabilities, including the establishment of QGCS. It also reinforces our intention to deliver excellence by benchmarking our performance and impact against leading international and domestic standards.

We will realise our purpose and vision through our people—by fostering a strong risk mindset, embracing innovation, and striving for excellence in everything we do. These pillars are central to how we deliver economic and social value for Queensland.

With the support of a strong and experienced Board, QTC’s Executive Leadership team is steering the organisation’s strategic direction with clarity and ambition. Together, they are empowering our high-performing workforce to deliver on our commitments and drive long-term success.

We extend our sincere gratitude to QTC’s team of skilled professionals for their continued dedication, expertise, and focus on delivering high-quality outcomes for Queensland. Their contribution is fundamental to our journey toward becoming a truly world-class financial partner of government.

S LING

Chief Executive Officer

25 August 2025

S BUCKLEY

Acting Chief Executive Officer (February 2025 – June 2025)

25 August 2025

*Face value is the dollar amount due to investors once a bond reaches maturity.

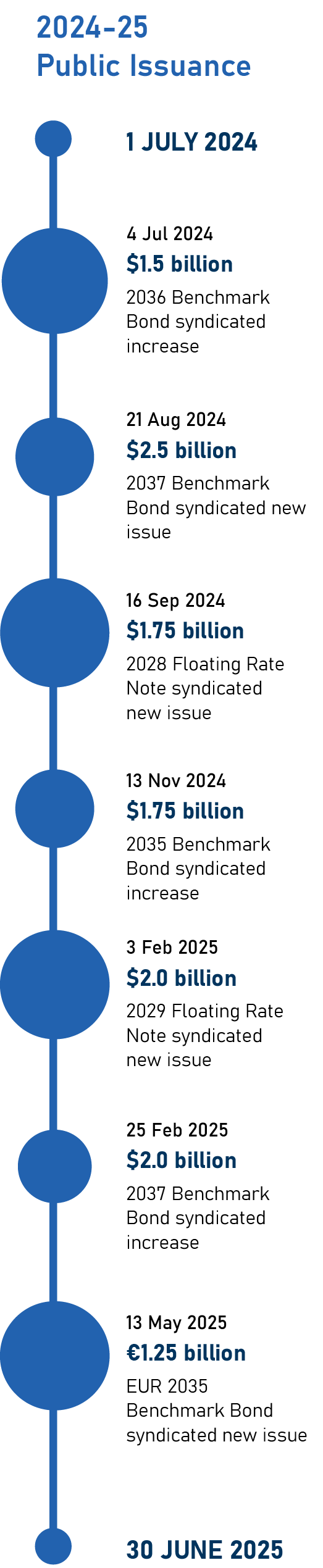

QTC completed the State’s $26.9 billion 2024-25 indicative term debt borrowing program on 13 May 2025 ahead of schedule, and raised an additional $2.6 billion towards the 2025-26 program. QTC continued to attract a diversified investor base, further supported by the establishment of four new bond lines.

Meeting the State’s funding requirements

QTC is an established bond issuer in global fixed-income markets and raises the funds needed by the State each year with its bond issues consistently over-subscribed.

On 11 June 2024, following the release of the 2024–25 State Budget, QTC announced it would raise $24.9 billion to meet the State’s term debt borrowing requirement.

On 23 January 2025, the requirement was increased by $2 billion to $26.9 billion, following the Queensland Mid-Year Fiscal and Economic Review (MYFER).

QTC met its borrowing requirement of $26.9 billion and raised an additional $2.6 billion. Issuance was executed through $13.7 billion in syndicated deals, $5.5 billion in tenders and $13.2 billion via reverse enquiry.

In 2024–25, QTC maintained the State’s strong liquidity position, which supported the State’s credit rating and provided reserves during periods of market volatility.

QTC’s well-managed funding program and reputation for high-quality debt issuance enabled Queensland to attract a broad and diverse investor base—including many new investors—to secure the necessary funds at cost-effective rates. To support this, QTC offered a wide range of high-quality financial securities aligned with investor needs.

2024–25 funding highlights included four new bond lines:

- EUR1.25 billion May 2035 benchmark bond

- AUD2.5 billion July 2037 benchmark bond

- AUD1.75 billion September 2028 floating rate note

- AUD2 billion May 2029 floating rate note.

On 24 June 2025, QTC announced its indicative $33.5 billion term debt borrowing requirement for 2025–26.

Funding performance

QTC’s proactive management of the State’s borrowing program and clients’ funding requirements continued to focus on smoothing the maturity profile of debt on issue. All fixed rate debt issued in 2024–25 was in maturities 2028 and longer.

Over the financial year, QTC kept the market informed with open and transparent information on funding activity and the State’s economic, fiscal, and Environmental, Social and Governance (ESG) commitments. This included regular market engagements through the Funding and Markets Division, digital communication channels, and virtual and face-to-face meetings and events.

QTC’s funding strategy continued to support its commitment to a diverse range of funding sources, complementing its core AUD benchmark bonds and offering investors flexibility in their investment options.

Sustainable finance

Since the inauguration of QTC’s Green Bond Program in 2017, QTC has contributed to the ongoing development of Australia’s sustainable finance market. As at 30 June 2025, QTC remained the largest Australian dollar green bond issuer with total outstanding across five green bond lines of approximately $13.1 billion at face value*.

Complementing QTC’s benchmark bond lines, green bonds supported diversification of QTC’s investor base and funding mix. This financial year, the existing 2031 and 2032 green bond lines were increased via a multi-tranche tender. This was the first time QTC had issued green bonds in this format. Additionally, the 2034 green bond line was increased through reverse enquiry.

Funding instruments

QTC has a diverse range of funding instruments in a variety of markets and currencies. The majority of QTC’s funding is sourced through long-term debt instruments, with QTC’s AUD benchmark bonds being the principal source of funding. As at 30 June 2025, QTC’s total debt outstanding was approximately $153.3 billion at face value*.

In May 2025, QTC issued a new EUR1.25 billion (~AUD2.15 billion) benchmark bond via syndication. This was the first time QTC had issued a benchmark bond denominated in euros. The issuance received significant demand with orders more than seven times the issuance amount.

Long-term debt instruments include Australian dollar denominated bonds (benchmark and non-benchmark) as well as multi-currency Euro Medium Term Notes (MTN) and United States MTN. Short-term instruments include domestic treasury notes, Euro Commercial Paper (CP) and US CP programs.

*Face value is the dollar amount due to investors once a bond reaches maturity.

Image

In 2024–25, QTC supported Queensland Treasury and other key clients to create value for Queensland. This work contributed to fiscal, economic and social benefits and more informed decision-making to enhance Queensland’s prosperity.

Financial advice for the State’s public sector

QTC worked closely with Queensland Treasury to deliver a program of work aligned with the Queensland Government’s priorities to maximise financial and social outcomes for the State. Key priority areas included energy, infrastructure, investment, housing and social services.

Highlights included:

- financial and risk advice – assisted Queensland Treasury with key projects including financial analysis of government initiatives and investment due diligence advice on high-priority projects

- capital program – continued to assist Queensland Treasury and the Department of State Development, Infrastructure and Planning with a coordinated program of work to help further inform and manage the whole-of-government capital program

- housing – continued to support Queensland Treasury and the Department of Housing and Public Works with several initiatives including infrastructure delivery strategies.

QTC delivered a broad range of financial advisory assignments with departments and agencies, local governments and Government Owned Corporations (GOCs) that supported these entities to deliver sound investment, manage risks, increase efficiencies and deliver broader social and economic outcomes.

Highlights included:

- GOCs – provided Queensland Treasury, shareholding departments and government businesses with insights into financial performance, analysis of corporate plan forecasts and identification of key risks for the businesses and their industries

- energy – continued to contribute to informing Queensland’s energy system through market modelling, analysis and research

- local government – supported the financial sustainability of the local government sector as financier and through treasury management, advisory and education services.

Enhancing financial capability in Queensland’s public sector

QTC provided education services to enhance financial decision-making across the Queensland public sector in partnership with world-class providers.

In 2024–25, QTC reached a wide range of public sector employees on a variety of different financial literacy topics through our Open Enrolment Program available to all Queensland Government employees and through custom tailored training designed for specific agencies. QTC also supported both new and returning learners with valuable insights into the trends in the economy via QTC’s webinar series.

In June 2025, QTC relaunched QTC Education with a new multi-provider model and expanded service offering, with the program set to commence in the 2025-26 financial year.

Financial risk management for Government Owned Corporations

QTC assisted GOCs with risk management, financial advisory, forecasting, capital structure and debt strategies, and regulated debt advice. This included GOC performance reviews for Queensland Treasury and detailed annual borrowing assessments and credit reviews, as well as funding options analysis for large infrastructure projects. QTC combined its deep quantitative and technical skills with a combination of equity and debt perspectives, to deliver timely and impactful commercial advice.

Fostering strong relationships with local government

QTC continued to work closely with State Government, local government and key stakeholders to support the delivery of financially sustainable council outcomes. In 2024–25, QTC delivered services to the local government sector such as:

- treasury management services including the provision of debt and investment advice and transactional services support

- financial advisory services, including the provision of risk, governance, project management, capital decision making, asset management and business case development assistance, to support local governments’ financial sustainability and sector capability, and

- education services and capability uplift training for council officers and elected members. This included ongoing support for the induction of new and returning elected members. In 2024-25, QTC also developed a new education offering for councils that supported elected members to analyse financial information and drive financially sustainable decision making.

In addition to delivering a range of education services to Queensland’s councils, in June 2025, QTC Education announced a partnership with the Department of Local Government, Water and Volunteers (DLGWV) to deliver a multi-year education service program for Elected Members, and council and department staff in the 2025-26 financial year.

During the period, QTC assisted with the implementation of DLGWV’s Local Government Sustainability Framework, and supported the DLGWV’s annual Finance Officer Network program, presenting at all eight of these regional forums.

QTC delivered a program of economic updates throughout the year, as well as contributed to sector events for the Local Government Association of Queensland (LGAQ) and Local Government Finance Professionals (LGFP).

Debt and risk management

QTC worked closely with its clients to provide debt management and liquidity products that delivered an efficient balance of lowest cost funding and risk focused outcomes.

Client onlendings increased by ~$22 billion across the year in review, as outlined in the table below. A close collaborative approach was taken with clients, particularly Queensland Treasury, to ensure new borrowing requirements were aligned to their objectives.

Loans to clients

|

Total Debt Outstanding |

Total Debt Outstanding |

|

|

General Government1 |

60,611,338 |

44,844,760 |

|

Government Owned Corporations |

33,047,844 |

28,969,503 |

|

Statutory Bodies2 |

19,586,085 |

17,835,369 |

|

Local Government |

6,977,277 |

6,301,907 |

|

Other Entities |

408,626 |

310,786 |

|

Total |

120,631,170 |

98,262,325 |

1 Includes other bodies within the public accounts

2 Includes Queensland water entities, universities, grammar schools and water boards

Cash management

QTC offered cash management products that enabled clients to increase the value of their surplus funds and manage liquidity requirements. The Cash Fund offered Queensland’s public sector organisations the opportunity to invest surplus funds for a short to medium-term investment horizon. In 2024–25, the Cash Fund delivered strong relative returns and outperformed the Bloomberg AusBond Bank Bill Index by 65 basis points. At 30 June 2025, funds under management were $11.35 billion.

The Cash Fund was underpinned by the quality of the investments, with 100 per cent of the Cash Fund investments having a long-term rating of ‘A-’ or higher by S&P Global Ratings as at 30 June 2025. Throughout the year, QTC continued to meet with clients to provide insights into the Cash Fund’s structure, strategy and performance. The Cash Fund provided clients with liquidity, while prudently managing money market and term assets in a volatile interest rate and credit spread environment.

Foreign exchange

QTC’s foreign exchange (FX) services, including its online platform, enable its public sector clients to access wholesale market rates and hedge against currency fluctuations. In 2024–25, the FX service continued to deliver strong volumes and savings for QTC’s clients (estimated savings ~$5.1 million). QTC continued to work with agencies to increase cost-saving opportunities through dual currency pricing for the procurement of goods manufactured offshore.

Carbon and commodities

Following the successful launch of the commodity hedging and environmental products trading capability, QTC began onboarding several Queensland Government entities interested in the facilitation of relevant transactions. QTC has since helped multiple clients manage their Australian Carbon Credit Units (ACCUs) generated by waste management projects. Additionally, QTC began assisting a number of clients with commodity exposures identified in large-scale infrastructure projects.

Economic research

In 2024-25, QTC delivered a range of economic research services to its clients. These services encompassed regular publications and topical research, in-person presentations and webinars, as well as additional support like highlighting research pertinent to clients’ areas of operations and addressing inquiries or requests.

In 2024–25, QTC’s performance was underpinned by a strong commitment to maintaining high organisational standards. This approach supported the achievement of corporate objectives and ensured that organisational risks were systematically identified, monitored, and effectively managed.

Operational excellence

In 2024-25, QTC enhanced operational performance by implementing key strategies in technology, change, people, and diversity. These initiatives were guided by our pillars of risk mindset, innovation and excellence, creating a great place to work, and client centricity.

Technology, system and business process enhancements

In the year under review, QTC settled $430 billion in transaction volume with zero cost of errors. The focus remained on automating processes, improving data quality, and maintaining system currency.

During the period, QTC launched its Data and Technology Strategy 2025-29. Developed collaboratively with stakeholders from all QTC business units, the strategy provides clear guidance to enhance the organisation’s agility and leverage new and emerging technologies while effectively managing

associated risks.

The Board approved enhancement of technology resources, supporting recruitment of personnel to strengthen key technology functions. This includes aligning evolving business requirements with strategic technology solutions and improved cyber risk visibility.

QTC demonstrated resilience in the face of natural disaster and technology disruption through robust contingency planning and effective crisis management. QTC ensured continuity of operations and maintained high service levels during these external events, underscoring QTC’s commitment to operational excellence and its ability to adapt to adverse conditions while safeguarding its stakeholders’ interests and maintaining trust.

Change portfolio

QTC’s 2024-25 change portfolio represented the corporation’s most significant investment in uplifting business and technology capabilities since 2016. Change activities were delivered by cross-functional teams from across QTC, providing substantial business benefit including strengthening our cyber posture, building robust technology and data capabilities, and improving the experiences of our clients, investors and employees. QTC’s Portfolio Management Office (PMO) function continued to provide dedicated portfolio governance and project delivery capability, increasing both the capacity and capability for change activities across the organisation. Over the period, the scope and mandate for the PMO was further refined to provide greater oversight and visibility of all change activities to the Executive Change Committee.

Corporate risk management and efficiency

Effective risk management remains a core business priority at QTC, with a proactive approach taken to identify and mitigate risks. Regular assurance is given to management and the Board regarding the effective design and operation of key internal controls.

As part of its ongoing commitment to excellence, QTC is in the process of further enhancing its risk management framework. Aligning with best practice, a comprehensive review of risks, controls and supporting policies is in progress.

QTC’s internal audit program in 2024–25 continued to focus on assessing and improving the effectiveness of key controls in managing and mitigating material risks. Improvements were implemented with Board oversight, to drive efficiency and ensure effective ongoing risk management.

Investment in additional resourcing across the three lines of defence further enhanced cyber risk management by clearly defining roles and responsibilities, improving communication and coordination, and enabling independent assurance. By systematically addressing cyber risks, the model enables comprehensive coverage and proactive risk management.

QTC continued to implement a comprehensive compliance training program to ensure staff understand risks and their obligations. All staff completed mandatory training on compliance topics including the Code of Conduct, Workplace Health and Safety, Discrimination, Insider Trading, Cyber risk and Privacy. Further, QTC provided specialised training in areas such as anti-money laundering and counter-terrorism financing, and Artificial Intelligence. QTC staff are required to affirm their compliance with QTC’s policies and procedures annually by completing the Annual Compliance Declaration.

QTC managed its portfolio market risk exposures within policy frameworks and approved limits throughout 2024-25, and continued to hold a portfolio of diverse, liquid financial securities that met the State’s liquidity requirements.

Enabling QTC to be a Great Place to Work

QTC launched its People Strategy 2025-29, outlining a four-year focus on enabling QTC to be a great place to work. The strategy makes organisational commitments to culture, leadership, talent and careers, and QTC’s employment offer. It also recognises the foundational roles of operational excellence, organisational architecture, compliance, systems and internal communications. The strategy will be implemented through annual programs of work reflecting QTC’s progress and growing organisational maturity. QTC continues to compete with the financial and professional services sectors to attract and retain its high calibre employees and hires employees on individual contracts, with employment practices aligned to the external market. In 2024-25, QTC enhanced its learning and development activities at all levels to ensure the currency of its workforce capability. Three pillars of QTC’s learning and development were:

- a 12-month leadership development program, investing in the enterprise and people leadership capabilities of QTC’s senior leadership and middle management cohorts

- the relaunch of the corporate professional development program, providing job relevant learning opportunities across a range of career levels and capability domains

- the launch of an internal mentoring program, providing QTC’s employees an opportunity to learn from more experienced peers and focusing on building cross-organisational connections.

This focus on employee capability will continue into 2025-26, including through an initiative under the People Strategy aimed at building a leadership community of practice.

QTC continued to embed practices and policies in response to Australia’s evolving employee relations landscape. A specific focus on psychosocial risk and supporting the wellbeing of our people will continue into 2025-26 through a discrete People Strategy initiative.

Diversity and wellbeing

QTC continues to enact the Diversity, Equity and Inclusion (DEI) Strategy for 2024–26 that was adopted in 2023. Activities over 2024-25 maintained QTC’s focus on advancing equity outcomes for women while broadening out engagement with other diversity groups. A complementary focus on inclusion, belonging and respect ensured the DEI activities were well embedded.

Key initiatives focused on enhancing employee diversity and wellbeing included:

- committing to the Reconciliation Action Plan (RAP) process through formally registering QTC’s intention to develop a Reflect RAP

- expanding QTC workforce’s access to First Nations cultural awareness activities, including a First Nations Book Library, eLearning and digital resources

- recognising DEI considerations in QTC’s Sustainability Working Group, particularly regarding QTC’s social and governance commitments

- continuing to embed flexible work practices

- increasing understanding of populations within the QTC workforce through expanding the demographics included in our Annual Engagement Survey, to reflect Diversity Council Australia guidelines and other forms of leading practice

- supporting the wellbeing and mental health of our people, including through maintaining and promoting our accredited Mental Health First Aid Officers, online wellbeing webinars, and ongoing access to an Employee Assistance Program

- supporting the physical health of our people through our employee benefit offering, including through our Fitness Passport subsidy and influenza vaccination programs

- supporting the financial wellbeing of our people through our employee benefits offering, including CBA Workplace Banking, SG Fleet, Bupa Health Insurance.

QTC also increased its focus on recognising days of significance across the organisation, including:

- International Women’s Day (IWD) 2025, through participating in the UN Women Australia IWD event, hosting an internal event with a women’s focused community organisation and making available women-focused financial wellbeing seminars

- NAIDOC Week 2024 and National Reconciliation Week 2025, through executive-hosted employee events learning about QTC’s work in Indigenous Councils and making cultural awareness opportunities

- RUOK? Day 2024, through organisational awareness raising and employee-organised organisational events

- Mental Health Week 2024, through externally facilitated wellness seminars, employee events organised by QTC’s Mental Health First Aiders and encouraging employees to take advantage of additional wellbeing time

- International Day of Persons with Disabilities, through organisational awareness raising, connection to community organisations and an employee event featuring a guest speaker with lived experience.

In 2024–25, QTC worked closely with its stakeholders to deliver key Environmental, Social and Governance (ESG) initiatives, including:

- providing institutional investors with expanded green investment opportunities via QTC green bonds

- supporting development of the Queensland Sustainability Report 2024

- providing QTC clients carbon offsets execution capability

- assisting the Queensland Government to deliver initiatives that support ESG outcomes for Queensland

- enhancing cultural awareness of First Nations Peoples

- providing organisational contributions that benefit the community.

QTC green bonds

QTC’s Green Bond Program supports Queensland’s pathway to climate resilience and an environmentally sustainable economy. It enables investors to contribute to positive environmental outcomes for the State of Queensland through a range of eligible projects and assets such as low carbon transport, renewable energy, land conservation and waste management.

QTC relies on the close partnership and support of government stakeholders to identify eligible projects and assets for inclusion in the green bond pool. In 2024-25, this led to the addition of a recovery and recyclables facility, bringing QTC’s green bond pool to $20 billion across 27 assets in six categories.

The size of QTC’s eligible asset pool allows the corporation to remain an ongoing green bond issuer, with the aim of increasing the liquidity in our green bond product to investors.

In May 2025, QTC published its 2025 Green Bond Annual Report. The annual report provides information on notionally allocated proceeds against eligible assets, description of assets and relevant performance indicators. Governance processes are set out in QTC’s Green Bond Framework that is aligned with the Climate Bonds Initiative (CBI) and International Capital Market Association (ICMA) standards.

During 2024-25, QTC initiated a strategic review of its Green Bond Program to ensure alignment with global markets and industry developments. In November 2024, QTC appointed Commonwealth Bank of Australia and RBC Capital Markets as joint Sustainable Finance Coordinators to support a comprehensive review of its Green Bond Framework.

Supporting the Queensland Sustainability Report 2024 and Government Emissions Measurement and Reporting Framework

QTC collaborated with the Queensland Government to develop the fourth Queensland Sustainability Report, which outlines the Queensland Government’s approach to managing sustainability risks and opportunities. The Report details the governance structures underpinning policy oversight and implementation, provides information on the Queensland Government’s commitments and policies for addressing sustainability risks and opportunities, and describes how these risks and opportunities are measured, monitored, and managed.

Concurrently, QTC supported Queensland Treasury in developing a framework for the consistent measurement and reporting of Whole of Government (WoG) greenhouse gas emissions. This project aims to ensure compliance with future sustainability accounting standards and to track progress against potential future government organisational emission reduction targets.

Providing QTC clients carbon offsets execution capability

QTC established and successfully facilitated execution in the carbon offsets secondary market, offering facilitation services to clients wanting to purchase or sell Australian Carbon Credit Units (ACCUs).

Assisting the Queensland Government to deliver initiatives that support ESG outcomes for Queensland

QTC continues to support Queensland’s energy transition through its work with the energy GOCs regarding strategic performance reviews, borrowing assessments, credit reviews and funding advice. QTC supported the government in the analysis of initiatives that support the energy transition and pathway to net zero emissions. QTC also worked closely with its clients on initiatives that support social outcomes for the State, including projects to support the Queensland Government to address challenges to meet the housing needs of Queenslanders and build solutions for regional local governments.

Enhancing cultural awareness of First Nations Peoples

QTC took an important step forward under its People and Diversity, Equity and Inclusion (DEI) Strategies, confirming its commitment to reconciliation by initiating the development of a Reflect Reconciliation Action Plan (RAP). The development of the RAP will be stewarded by an executive-led working group with representation from across the organisation. The working group will support QTC in reflecting on its historical and present relationships with First Nations people in Queensland and consider the contributions the organisation can make in furthering reconciliation. The working group recently commenced its journey through volunteering with a First Nations-oriented community program.

Commencing the RAP process is a logical extension of QTC’s ongoing commitment to enhancing its employees’ cultural awareness of First Nations Peoples. This includes the ongoing recognition of key dates of significance, provision of cultural awareness learning and development opportunities and resources, and relationships with First Nations suppliers.

Providing organisational contributions that benefit the community

QTC contributed to a range of social and community initiatives in 2024–25, including in both a corporate capacity and through activities of employees. QTC has maintained its organisational relationship with meal relief charity, FareShare, which has recently expanded through the RAP Working Group’s participation in the Meals for the Mob program. QTC also continued its partnership with Stepping Stones, supporting people living with mental illness with employment opportunities and connection with community.

Utilising QTC’s paid community leave day, employees have continued to volunteer for organisations such as FareShare and Dressed for Success. QTC also facilitated donation opportunities which allowed employees to contribute to causes such as Dressed for Success and the Share the Dignity drive.

QTC is committed to maintaining the high standards of governance, transparency and accountability expected in the public sector to support the achievement of QTC’s objectives in accordance with legislative and regulatory obligations, fulfillment of QTC’s purpose and maintenance of the corporation’s sustainability.

QTC and its Boards

- the Queensland Treasury Corporation Capital Markets Board (the Board), established in 1991 to manage all of QTC’s operations except those relating to certain superannuation and other long-term assets, and

- the State Investment Advisory Board (SIAB), established in July 2008 to manage the State’s long-term investment assets.

QTC Capital Markets Board

The Under Treasurer, as QTC’s corporation sole, and the QTC Capital Markets Board have agreed on the terms and administrative arrangements for exercising the powers that the corporation sole has delegated to the Board.

The Board operates in accordance with its charter, which sets out its roles and responsibilities (based on its delegated powers), and the conduct of meetings. The charter provides that the role and functions of the Board are to:

- take responsibility for the corporate governance of QTC

- set strategic direction, policies and risk appetite

- promote and monitor the organisational culture

- monitor the implementation of QTC’s strategy

- ensure the effectiveness of the risk management framework

- monitor QTC’s financial and business performance

- ensure compliance with legal and regulatory obligations

- ensure integrity of reporting, and

- safeguard the reputation of QTC.

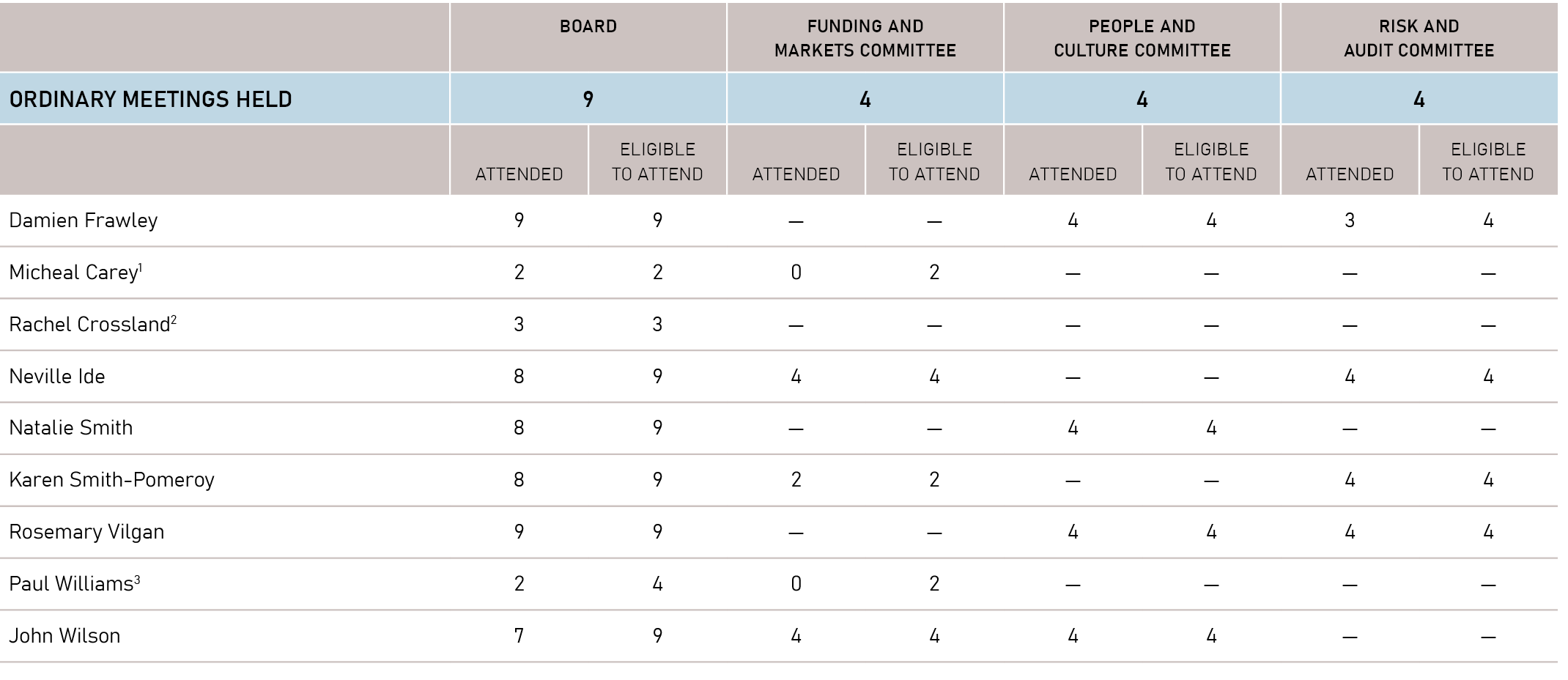

The Board typically holds at least eight meetings each year and may, whenever necessary, hold additional meetings.

Board appointments

The Board consists of members appointed by the Governor-in-Council, in accordance with section 10(2) of the QTC Act. Each Board member is selected based on their qualifications, experience, skills, strategic ability, and commitment to contributing to QTC’s performance and achieving its corporate objectives. The Board is composed of a Queensland Treasury ex officio representative and non-executive members.

Conflict of interest

Board members are required to monitor and disclose any actual or potential conflicts of interest. Unless the Board decides otherwise, a conflicted Board member may not receive any Board papers, attend meetings, or take part in decisions relating to their declared interests.

Performance and remuneration

To ensure continuous improvement and enhance overall effectiveness, the Board conducts an annual assessment of its performance. Board members’ remuneration is determined by the Governor-in-Council, with details disclosed in QTC’s financial statements.

Board committees

The Board has established three committees, each with its own charter, to assist in overseeing and governing various QTC activities. The complete roles and responsibilities of each committee are outlined in their charters, available on the QTC website.

Funding and Markets Committee

The Funding and Markets Committee assists the Board to fulfill its corporate governance responsibilities related to borrowing, liquidity, onlending, financial risk management and non-debt financial services. The Committee makes strategic recommendations, monitors implementation, and reports to the Board on performance. It also oversees QTC’s financial risk management culture and relevant policies, and ensures compliance with legal and regulatory obligations. The Committee meets at least four times a year and comprises at least three Board members.

People and Culture Committee

The People and Culture Committee assists the Board to fulfill its corporate governance responsibilities related to people, culture, and remuneration. The Committee makes strategic recommendations, monitors implementation, and reports to the Board on performance. It oversees QTC’s organisational culture, values, behaviours and relevant policies, and ensures compliance with legal and regulatory obligations. The Committee also monitors people and culture related risks and key management personnel development and remuneration. The Committee meets at least three times a year and comprises at least three Board members.

Risk and Audit Committee

The Risk and Audit Committee assists the Board to fulfill its corporate governance responsibilities related to QTC’s enterprise risk management framework, compliance, financial reporting and audit. The Committee makes strategic recommendations, monitors implementation, and reports to the Board on performance. It oversees QTC’s risk and control culture and relevant policies, and ensures compliance with legal and regulatory obligations. The Committee meets at least four times a year and comprises at least three Board members.

During the year, the Risk and Audit Committee recommended the adoption of annual financial statements, reviewed external and internal audit reports and the progress in implementing the recommendations from those reports, approved QTC’s Internal Audit Plan and reviewed the Queensland Audit Office’s External Audit Plan.

Advisory and Consulting Committee

In June 2025, the Advisory and Consulting Committee was established to assist the Board to fulfill its corporate governance responsibilities relating to Queensland Government Consulting Services and QTC advisory services. The Committee commenced its responsibilities on 1 July 2025.

Meetings held

1 This position is an ex officio appointment within Queensland Treasury. Mr Carey’s term on the Board ended on 31 October 2024.

2 This position is an ex officio appointment within Queensland Treasury. Ms Crossland’s term on the Board was from 1 November 2024 to 23 February 2025.

3 This position is an ex officio appointment within Queensland Treasury. Mr Williams started on the Board on 24 February 2025.

| DAMIEN FRAWLEY

Chair Board Committees

|

Damien Frawley has more than 35 years’ experience in the financial services sector, both domestically and internationally. From 2012 to 2022, he was the Chief Executive of Queensland Investment Corporation (QIC), responsible for more than $100 billion in assets under management for a range of government, domestic and global institutional investors. Prior to QIC, Mr Frawley was Blackrock’s Australian Managing Director and Chief Executive Officer from 2010 to 2012, after joining as its Head of Institutional and Retail in 2007. He also held senior roles at Merrill Lynch Investment Management, Barclays Global Investors and Citibank. Mr Frawley is the Independent Chair of Hostplus, a non-executive director of Mirvac Group, a director of Blue Sky Beef and a non-executive director of Elders Limited. |

| NEVILLE IDE

BBUS (ACCTG), Appointed 1 October 2018 Board Committees

|

Neville Ide has more than 40 years’ experience in financial markets and treasury management, having held executive positions in the banking, finance and government sectors. Mr Ide’s industry knowledge and experience covers banking, insurance, infrastructure and corporate treasury management, including debt and equity capital markets, balance sheet structuring and financial risk management. Mr Ide has served as a non-executive director on several public and private company boards since 2006. He is currently the Chair of Seqwater. |

| DR NATALIE SMITH

BSC (COMP SC & MATHS), M HR & ORG DEV, RESEARCH MASTERS FLEX WORK PRAC, PHD GOV DIGITAL TRANS Appointed 21 September 2023 Board Committees

|

Dr Natalie Smith has over 30 years’ experience in technology and transformation consulting, predominantly in financial services and government. She has a combination of executive, corporate governance and academic expertise in digital and transformational projects. Dr Smith is currently an Industry Fellow at the University of Queensland. Her governance roles include Deputy Chair of UnitingCare Queensland and member of St John of God Health Service’s Digital, Information and Technology Committee. She is also a member of the National AI Centre’s Responsible AI Thinktank and of the Digital Expert Reviewer Panel for the New South Wales Government. Previously, Dr Smith was an Associate Professor in Practice at the University of Sydney, a partner in Deloitte’s Risk Advisory practice, Deputy Chair of Mercy Community Services, and a member of the Financial Investment and Property Board for the Uniting Church in Queensland. |

| KAREN SMITH-POMEROY

ADIP (ACCOUNTING), GAICD, FIPA, FFA, Appointed 9 July 2015 Board Committees

|

Karen Smith-Pomeroy is an experienced financial services senior executive with a specialty in risk and governance. Ms Smith-Pomeroy held senior executive roles with Suncorp Group Limited from 1997 to 2014, including as Chief Risk Officer of Suncorp Bank from 2009 to 2013, and Executive Director, Suncorp Group subsidiary entities from 2009 to 2014. She is an experienced director and committee chair with prior roles on a number of listed and unlisted company boards and committees. Ms Smith-Pomeroy is currently Chair of Regional Investment Corporation, and a non-executive director of Kina Securities Limited and National Reconstruction Fund Corporation. She is also Chair of the Queensland Department of State Development, Infrastructure and Planning Audit and Risk Management Committee, Chair of the Queensland Department of Natural Resources and Mines, Manufacturing and Regional and Rural Development Audit and Risk Committee, and a member of the Audit and Risk Management Committees for the Queensland Department of the Premier and Cabinet and Public Sector Commission, and South Bank Corporation. |

| ROSEMARY VILGAN

BBUS, DIP SUPN MGT, FAICD, FASFA Appointed 1 October 2020 Board Committees

|

Rosemary Vilgan is an experienced non-executive director, with specific expertise in financial services and business leadership and transformation. She was the Chief Executive of QSuper, a global financial services business with $90 billion in accounts, from 1998 until 2015. She is currently Chair of Vincent Fairfax Family Foundation, a member of the Cambooya Investment Committee, and a member of the Future Fund Board of Guardians. Ms Vilgan’s former roles include Chairperson of the Federal Government’s Safety, Rehabilitation and Compensation Commission, a member of the Board of the Children’s Hospital Foundation (Qld), a member of the Board of the Guardians of New Zealand Superannuation, and a Queensland council member of AICD. She is a former Councillor, Deputy Chancellor and Chairperson of the Audit and Risk Committee at Queensland University of Technology (QUT), and a former director and Chair of the Board of the Association of Superannuation Funds of Australia (ASFA). In 2013, Ms Vilgan was named the Telstra Australian Businesswoman of the Year. |

| PAUL WILLIAMS

Member, Funding and Markets Committee Board Committees

|

Paul Williams commenced as Under Treasurer in February 2025. He is an experienced senior executive with more than 25 years’ experience in the banking and finance sector. He has held Board and Committee positions across funds management, hospitality, sport and the not-for-profit sector. Most recently he was the Chief Financial Officer with People First Bank and has previously held executive roles in strategy advisory, finance and investment with Arthur Andersen, Heritage Bank, and the Bank of Queensland. Mr Williams is also a director of South Bank Corporation, a member of the Board of Cross River Rail Development Authority, a member of the Australian Retirement Trust Advisory Board, and the President of the Tattersalls Club. |

| JOHN WILSON

BA, LLB, LLM, MA Appointed 15 December 2022 Board Committees

|

John Wilson has more than 35 years’ experience in investment and capital markets. Mr Wilson was most recently a Senior Advisor and Managing Director at Goldman Sachs Asset Management. He spent the majority of his executive career at the fixed income manager, PIMCO. Mr Wilson currently serves as a special advisor to Brighter Super, a consultant to Blue Owl Capital, and as a Director of Jacobs Williams Pty Ltd. His previous directorships include Ord Minnett, QIC, LGIASuper, Etihad Stadium, Rugby Australia and the UNE Foundation. He was Chairman of the Australian Rugby Foundation and Chairman of the NSW Aboriginal Lands Council Investment Committee. |

QTC Executive Leadership team

The responsibility for the day-to-day operation and administration of QTC is delegated by the Board to the Chief Executive Officer and the Executive Leadership team. The Chief Executive Officer is appointed by the Board and executives are appointed by the Chief Executive Officer. Executive Leadership team appointments are made on the basis of qualifications, experience, skills, strategic ability, and commitment to contribute to QTC’s performance and achievement of its corporate objectives.

QTC’s Executive Leadership Team

as at 30 June 2024

| Simon Ling1 | Chief Executive Officer |

| Susan Buckley2 | Managing Director – Funding and Markets |

| Maryanne Kelly | Acting Managing Director – Advisory |

| Chris Noot1 | Managing Director – Risk, and Chief Risk Officer |

| Stephanie Challen | Acting Managing Director – Business Services, and Chief Operating Officer |

| Lona Baskerville | Chief People Officer |

1 Commenced on 30 June 2025

2 Acting Chief Executive Officer from 19 February 2025 to 29 June 2025

Internal audit

The Financial and Performance Management Standard 2019 (Qld) (Standard) governs the operation of QTC’s internal audit function. QTC outsourced its independent internal audit function for the 2024–25 financial year. Internal Audit reports to the Board, via the Risk and Audit Committee, consistent with the relevant audit and ethical standards. The role of internal audit is to provide the Board (through the Risk and Audit Committee) with independent and objective assurance and advice on the adequacy and effectiveness of QTC’s governance and risk management (including controls).

Internal audit is responsible for:

- developing an annual audit plan, based on the assessment of strategic, financial and operational risks with regard to QTC’s purpose and strategy, which is approved by the Risk and Audit Committee

- providing regular audit reports and periodic program reports to the management team and the Risk and Audit Committee, and

- working constructively with QTC’s management team to challenge and improve established and proposed practices and to put forward ideas for process improvement.

External audit

In accordance with the provisions of the Auditor-General Act 2009, the Queensland Audit Office is the external auditor for QTC. The Queensland Audit Office has the responsibility for forming opinions about the reliability of QTC’s financial statements, along with other public sector entities, with the results of these financial audits tabled in Queensland’s Parliament.

All audit recommendations raised by the Queensland Audit Office that were due during the reporting period were addressed.

State Investment Advisory Board

The State Investment Advisory Board (SIAB) was established in 2008 as an advisory Board of Queensland Treasury Corporation under section 10 of the QTC Act. The SIAB was established to manage long-term assets for the State by a board independent of QTC’s capital markets operations. The long-term assets have no impact on QTC’s capital markets operations and there is no cash flow effect for QTC.

In 2024–25, with power delegated from QTC, the SIAB was responsible for:

- oversight of the financial assets set aside by the Queensland Government to meet future employee liabilities and other long-term obligations of the State

- oversight of the financial assets set aside to support long-term initiatives of the Queensland Government, and

- providing investment governance assistance in connection with the Financial Provisioning Fund established under the Mineral and Energy Resources (Financial Provisioning) Act 2018 and the National Injury Insurance Scheme Fund, Queensland.

The SIAB members are appointed by the Governor-in-Council, in accordance with section 10(2) of the QTC Act.

Remuneration for the SIAB members is determined by the Governor-in-Council.

|

Position |

Attended |

Eligible |

|

|

Dennis Molloy, Deputy Under Treasurer1 |

Chair |

4 |

4 |

|

William Ryan, Head of Fiscal1 |

Member |

4 |

4 |

|

Philip Graham, External Member |

Member |

3 |

4 |

|

Cate Wood AM, External Member |

Member |

4 |

4 |

|

Wendy Tancred, External Member |

Member |

4 |

4 |

|

Brendan O’Farrell, External Member |

Member |

4 |

4 |

1 This position is an ex officio appointment within Queensland Treasury.

SIAB Board Members as at 30 June 2025

DENNIS MOLLOY

Chair

Appointed 24 April 2024

Tenure to 30 September 2025

Dennis Molloy commenced as Deputy Under Treasurer of Queensland Treasury’s Economics and Fiscal Group in May 2021. He has been closely involved in all Queensland State Budgets since 2010. He also worked as the Executive Director of Economic Policy in the Department of the Premier and Cabinet and took a particular interest in policies that would facilitate growth of the Queensland economy. Mr Molloy started his career as an economist with the Commonwealth Treasury and enjoyed over a decade engaged in economic forecasting, competition policy, Commonwealth-state financial relations, and advising the Commonwealth Treasurer on the health, education, social security and defence portfolios.

PHILIP (PHIL) GRAHAM

BA (ECON. HONS), MCOM (FIN, HONS), CFA, GAICD

Appointed 4 July 2019

Tenure to 30 September 2027

Phil Graham has extensive experience in investment management, financial markets, and economic policy. He is an independent member of the Lonsec Asset Allocation Committee and a consultant to AustralianSuper. Mr Graham was Senior Portfolio Strategist and Deputy Chief Investment Officer at Mercer from 2007-18. He also held senior roles at QIC and Access Capital Advisors, and prior to this he worked for the Reserve Bank of Australia and the ANZ Banking Group. Mr Graham is a past-President of the CFA Society of Melbourne and was the President’s Council Representative for the CFA Asia Pacific North and Oceania region in 2015-19. He currently serves on the CFA Disciplinary Review Committee and is a trustee of the Research Foundation of the CFA Institute.

BRENDAN O’FARRELL

MBA, GAICD, DIPSM

Appointed 21 September 2023

Tenure to 30 September 2026

Brendan O’Farrell is an experienced Non-Executive Director. He has more than 25 years’ financial services experience in senior executive roles including as Chief Executive Officer and Chief Investment Officer with his most recent role as Chief Executive Officer (including Chief Investment Officer) of lntrust Super from 2005-21. He currently runs his own consulting business, Maple Tree Consulting Pty Ltd. Mr O’Farrell’s current directorships include Queensland Teachers’ Union Health Fund (Member of the Risk and Audit Committees), Windsor Income Protection Pty Ltd (Chair of Audit and Risk Committee and member of Remuneration Committee), Queensland Rugby Football League Ltd (Member of Audit and Risk Committee), Broncos Leagues Club Pty Ltd, Stadiums Queensland (Chair of Strategy and Planning Committee and Member of the Remuneration Committee), Chair of CMBM Facility Services Advisory Board, and Chair of Economic Development Queensland (member of Audit, Risk and Performance, and People and Culture Committee).

WILLIAM RYAN

BBUS (BANKING AND FIN), GRAD CERT POLICY ANALYSIS

Appointed 19 November 2020

Tenure to 30 September 2025

William Ryan is the Head of Fiscal, Queensland Treasury, with responsibilities for managing the State’s budget and balance sheet, and ensuring the long-term sustainability of Queensland’s fiscal position. He forms part of Queensland Treasury’s Senior Leadership Team and serves as a member of the Queensland Government Insurance Fund Governance Committee. Prior to his current role, Mr Ryan held senior leadership roles in Queensland Treasury over a 21-year career. These roles have included developing investment programs, financial assurance modelling, infrastructure program and economic policy analysis.

WENDY TANCRED

BCOM, CPA, DIPFP, CSM, GRAD CERT MGMT. FFIN, FAICD

Appointed 21 September 2023

Tenure to 30 September 2026

Wendy Tancred has more than 35 years’ experience in the financial services industry, including banking, financial planning and superannuation. Following executive roles within AMP and Westpac, she was the Chief Executive Officer of two superannuation funds and a trustee director. While also having Chief Executive Officer and director roles in other industries, the majority of Ms Tancred’s career has been in highly regulated sectors, ensuring strong risk management and governance capability. She has deep investment expertise gained across multiple roles with a focus on long-term drivers of sustainable outcomes.

CATE WOOD AM

BSS, DIP FP, GAICD

Appointed 7 July 2022

Tenure to 30 September 2025

Cate Wood has more than 25 years’ experience in the superannuation industry. Ms Wood was Executive Officer and a Director of AGEST Super, a Director and Chair of CareSuper, a Director of SunSuper, and served on the Investment Committees of these funds. Ms Wood was a Director of the Industry Superannuation Property Trust (ISPT) and a Member of the ACT Investment Advisory Board. She is currently a Member of the Professional Standards Councils and Chair of the Centre for Workers’ Capital.

Financial Statements

QTC Annual Report 2024–25_financial_statements (Download pdf, 2,380KB)

Appendices

QTC Annual Report 2024–25_appendices (Download pdf, 482KB)

Availability of annual reports

QTC’s annual reports (ISSN 1837-1256) are available on QTC’s website for the past five financial years, earlier years are available by request. Printed copies can also be provided; please contact us for further information.

Feedback

We are committed to continually improving our Annual Report. Your feedback on QTC’s Annual Report, including presentation, ease of navigation, value of information, style of language, level of detail and suggestions for improvement, can be provided via our online enquiry form.

Disclaimer

The materials presented on this site are provided by the Queensland Treasury Corporation for information purposes only. Users should note that the electronic versions of the Annual Report on this site are not recognised as the official or authorised version. The official copy of the Annual Report, as tabled in the Legislative Assembly of Queensland, can be accessed from the Queensland Parliament tabled papers website database.