2017-18 Annual Report (text version)

The Queensland Treasury Corporation Annual Report 2017-18 provides details of Queensland Treasury Corporation’s (QTC’s) achievements, outlook, performance and financial position for the 2017-18 financial year.

29 August 2018

The Honourable Jackie Trad MP

Deputy Premier, Treasurer and Minister for Aboriginal and Torres Strait Islander Partnerships

GPO Box 611

Brisbane QLD 4001

Dear Treasurer

I am pleased to present the Annual Report 2017–18 and financial statements for Queensland Treasury Corporation.

I certify that this Annual Report complies with:

- the prescribed requirements of the Financial Accountability Act 2009 and the Financial and Performance Management Standard 2009, and

- the detailed requirements set out in the Annual Report requirements for Queensland Government agencies.

A checklist outlining the annual reporting requirements can be found at page 58 of this Annual Report or accessed at www.qtc.com.au.

Sincerely

Gerard Bradley

Chairman

Queensland Treasury Corporation (QTC) has a statutory responsibility to advance the financial position of the State, and a mandate to manage and minimise financial risk in the public sector and provide value-adding financial solutions to its public sector clients. Established under the Queensland Treasury Corporation Act 1988, QTC is a corporation sole, reporting through the Under Treasurer to the Treasurer and the Queensland Parliament.

VISION

Securing Queensland’s financial success

MISSION

To deliver optimal financial outcomes through sound funding and financial risk management

VALUES

CLIENT FOCUS

We build strong partnerships with our clients to deliver simple and well-designed solutions that achieve quality outcomes for Queensland.

TEAM SPIRIT

We work as one team, taking joint responsibility for achieving our vision and collaborating to achieve outstanding performance.

EXCELLENCE

We aim for excellence using flexible and agile processes to continuously improve.

RESPECT

We show respect by recognising contributions, welcoming ideas, acting with honesty, being inclusive and embracing diversity.

INTEGRITY

We inspire trust and confidence in our colleagues, clients, stakeholders and investors by upholding strong professional and ethical standards.

2018-22 STRATEGIC GOALS

STRATEGIC GOALS

1. State and client value

2. Sustainable funding

3. Organisational excellence

As the Queensland Government’s central financing authority, Queensland Treasury Corporation plays a pivotal role in securing the State’s financial success.

With a focus on whole-of-State outcomes, QTC provides a range of financial services to the State and its public sector entities, including local governments. These services include debt funding and management, cash management facilities, financial risk management advisory services, and specialist public finance education.

Debt funding and management

QTC borrows funds in the domestic and global markets in the most cost-effective manner and in a way that minimises liquidity risk and refinancing risk. QTC achieves significant economies of scale and scope by issuing, managing and administering the State’s debt funding.

QTC works closely with Queensland’s public sector entities, including local governments, to assist them to effectively manage their financial transactions, minimise their financial risk and achieve the best financial solutions for their organisation and the State.

Cash management facilities

QTC assists the State’s public sector entities to make the best use of their surplus cash balances within a conservative risk management framework. It offers overnight and fixed-term facilities and a managed cash fund.

Financial risk management advisory services

QTC offers a range of financial risk management advisory services to clients, including:

- support to ensure financial risks are identified and effectively managed

- advice on financial and commercial considerations

- expertise in financial transactions and structures

- project management support to deliver key project outcomes, and

- collaboration with the financial markets and private sector institutions.

Specialist public finance education

QTC offers a range of education and training courses through its partnership with the University of Queensland, that complements its products and advisory services and allows it to share its specialist financial, commercial, treasury management and risk management expertise with clients. Courses are developed and delivered by experienced professionals and industry experts.

In 2017-18, Queensland Treasury Corporation (QTC) delivered significant whole-of-State and client benefits, funded the State’s $7 billion borrowing program and realised an operating profit of $94 million from its capital market operations.

Funding the State

Ongoing investor demand for QTC’s AUD benchmark bonds supported the successful execution of the $7 billion 2017-18 borrowing program.

While global economic conditions have continued to improve, political and geopolitical tensions have contributed to increased market volatility in the operating environment. Queensland has benefited from stronger commodity prices, which has enabled the Government to reduce its debt without impacting frontline services or targeted infrastructure spending. The State’s borrowing requirements for new money are forecast to remain modest over the next two financial years, before increasing to support large-scale infrastructure projects.

Against this backdrop, QTC achieved strong funding outcomes, including:

- Early completion of the $7 billion 2017-18 borrowing program and pre-funding of an additional $3.5 billion towards future borrowing programs, a total of $10.5 billion

- Issuance of $8 billion of benchmark bonds, including one new benchmark bond maturing in 2030 that helped smooth and extend QTC’s bond maturity profile

- Issuance of $2 billion into a new floating rate note, maturing in 2022, and

- Strong returns and benchmark outperformance of QTC’s Capital Guaranteed Cash Fund, which remains one of the largest managed funds in Australia with $8.3 billion under management.

Operating results

In 2017-18, QTC recorded an operating profit after tax from its capital markets operations of $94 million (2016-17: $129 million), mainly attributable to earnings on capital, plus fair value accounting gains associated with the management of QTC’s funding task and balance sheet.

Separate from QTC’s capital markets operations, QTC’s long-term assets, which comprises the investments set aside primarily to support the State’s defined benefit superannuation, recorded an after tax operating loss of $194 million (2016-17: $224 million profit). These long term assets were transferred to QTC by the Queensland Government under an administrative arrangement in 2008; in return, QTC issued fixed-rate notes to the State that provide a fixed rate of return. The operating loss represents the difference between the return received net of fees ($1.9 billion) on the assets managed by QIC, and the return ($2.1 billion) provided by QTC under the Fixed Rate Note agreement with Treasury. While QTC bears the fluctuations in the value and returns on the asset portfolio, there is no cash flow effect for QTC. Any losses incurred by this segment have no impact on QTC’s capital markets activities or its ability to meet its obligations.

Credit ratings

In the year under review, both Standard & Poor’s and Moody’s Investors Service reaffirmed Queensland’s and QTC’s credit ratings. QTC is rated AA+/A-1+/Stable and Aa1/P-1/Stable by Standard & Poor’s and Moody’s Investor Services respectively. These stable ratings are a key reason for continued demand from domestic and global investors for QTC debt.

Value delivered for the State

In 2017-18, QTC prioritised client advisory initiatives that would provide the greatest opportunity for service improvements and the creation of value for the client and the State. Some of these highlights included:

- working with Queensland Treasury to review the programs and expenditure of three major clients

- working with Queensland Health to develop ‘future state’ design for their supply chain, and optimise procurement services

- developing financial forecasting models to improve business outcomes for three Government departments

- advising the Department of Environment and Science on the development of the State’s new waste levy

- centralising the State’s cash holdings, in line with the Government’s Debt Action Plan

- providing cash management products that provided both performance and flexibility to help clients maximise the value of their surplus funds, and

- working with local governments to implement asset management improvement projects, complete strategic financial reviews, and develop a high-level diagnostic tool to assess councils’ financial and infrastructure health.

QTC also helped enhance financial capability across the public sector through its education partnership with the University of Queensland. Over the year, more than 1,200 participants completed financial education courses; these courses achieved an average evaluation rating of nine out of 10.

Organisational excellence

With its ongoing focus on organisational excellence, QTC continues to provide its employees with both the opportunity and the environment to prioritise their activities to maximise the delivery of real value to the State. During the year, a number of system and process improvements have been implemented, improving accuracy, efficiency and security.

Risk management has remained an active priority, with ongoing commitment to QTC’s enterprise-wide risk management framework.

Employee engagement is tracking well, with 2018 survey results showing overall employee engagement at 74% (financial services benchmark is 62%), which is aligned to the top 10% of responses when compared to survey participants from more than 50 financial services organisations globally.

Changes to Board membership

Queensland Treasury department representative on the QTC Capital Markets Board, Warwick Agnew, resigned from the Board on 25 May 2018 following his appointment as Director-General of the Department of Local Government, Racing and Multicultural Affairs. Stephen Roberts resigned from the Board on 1 June 2018. Both Mr Agnew and Mr Roberts made a significant contribution to QTC’s success during their respective tenures and, on behalf of the Board, we thank them for their dedication and contribution.

Positioned for ongoing success

QTC’s achievements in the 2017-18 financial year have demonstrated significant performance outcomes against each of its three strategic goals — to deliver value to the State and its clients; to ensure access to sustainable funding; and to achieve organisational excellence — and provided measurable increases in organisational capability and efficiency.

With QTC’s expert leadership team and talented employees, we are confident QTC will be able to contribute a significant, meaningful and tangible benefit to help secure the State’s financial success in 2018-19 financial year and beyond.

Creating value for the State and clients

In 2017-18, QTC contributed significant, positive financial results for the State and its public sector entities through the delivery of debt funding and management, cash management, and financial advisory services. Underpinning this success has been a continued focus on delivering whole-of-State outcomes by providing advice and identifying initiatives that enable clients to make better business decisions.

In the year under review, QTC completed a broad range of financial advisory assignments to assist its clients and the State to address financial risk management issues and make informed business decisions. QTC’s client engagements are focused on areas of government that provide the greatest opportunity for service improvements and the creation of value for the client and the State. Assignments included:

- program and spend reviews for clients including Queensland Police Service, Department of Housing and Public Works and Queensland Corrective Services

- ‘future state’ design for the Queensland Health supply chain

- optimisation of Queensland Health’s procurement services

- pricing framework and pricing strategy development for a range of clients

- revenue and pricing modelling to support water and wastewater valuation model updates, and

- developing financial forecasting models to improve business outcomes for the departments of Justice and Attorney General, and Health and Education.

QTC’s advisory assignments range in scope, complexity and monetary value and contribute to creating the best outcomes for Queensland.

Enhancing cash management opportunities

Building on the work completed in the 2016-17 financial year in partnership with Queensland Treasury, QTC facilitated a centralisation of cash holdings. This is aligned to the Government’s Debt Action Plan, providing a net accounting interest benefit of $29 million.

Financial advice supporting major policy initiatives

QTC provided financial advice supporting major policy initiatives in economic agencies, including:

- Agriculture: Independent Productivity Enhancement Scheme review for Queensland Rural and Industry Development Authority (QRIDA) resulted in 11 recommendations to deliver a more targeted approach to value capture, support the desired policy outcomes, and estimate and increase public benefits

- Natural Resources: Completion of three competitive tender assessments for Department of Natural Resources, Mines and Energy confirming the financial capability of tenderers

- Racing Queensland: Designed a country and regional racing package as part of an overall racing infrastructure plan, providing a major component of the overall commercial plan for the growth of racing in Queensland and to ensure sustainable communities, and

- Land restoration: Assisted the Department of Environment and Queensland Treasury in establishing the Land Restoration Fund, including structural and funding advice, green bond funding and creation and monetisation of carbon credits.

Fostering strong relationships with local governments

Throughout the year, QTC has worked closely with local government clients and assisted them to identify and mitigate business risks including:

- asset management improvement projects, including development of a detailed asset management roadmap to improve local government asset management practices

- completing strategic financial reviews for a number of local councils, and

- development of a High Level Diagnostic tool to assess councils’ financial and infrastructure health in a condensed timeframe.

QTC has also supported local and regional Queensland in partnership with local governments through a range of activities including:

- sponsorship and provision of content and speakers for the 6th Local Government Financial Sustainability Summit, and

- undertaking numerous regional site visits, in order to better understand regional economic opportunities and gain insights into the unique challenges of each region.

Facilitating sustainable funding

QTC continued to build on the success of its inaugural Green Bond issue by becoming a programmatic issuer. QTC also increased the size of its Climate Bonds Initiative (CBI) eligible asset pool to $4.6 billion through the verification of additional low carbon electrified transport assets.

QTC continued to provide low-cost loans and high-performing investment facilities throughout 2017-18.

Debt management

QTC has continued to successfully deliver its core mandate of providing clients with a lower cost of funds by capturing the significant economies of scale and scope in the issuance, management and administration of the State’s debt.

Cash management

QTC offers cash management products that enable its clients to maximise the value of their surplus funds. In 2017-18, QTC’s Capital Guaranteed Cash Fund provided strong returns and outperformed its benchmark, the Bloomberg AusBond Bank Bill Index, by 73 basis points. The Cash Fund continues to offer flexibility by providing clients with same-day liquidity as required. At the end of the 2017-18 financial year it remained one of the largest managed funds in Australia with $8.3 billion under management.

Client access website portal

In 2017-18, QTC upgraded QTC Link – QTC’s industry-standard online transaction platform, and transitioned 100 per cent of eligible clients to transacting online.

Through the partnership with the University of Queensland (UQ), QTC provided finance education courses to more than 1,200 participants. These courses were provided as a mixture of workshops, masterclasses and webinars. Average post-course evaluation rating was nine out of 10. The program is on budget under the sharing arrangement with UQ.

| Total Debt Outstanding (Market Value) 30 June 18 A$000 |

Total Debt Outstanding (Market Value) 30 June 17 A$000 |

|

| General Government* | 31 200 556 | 33 655 316 |

| Energy | 24 603 252 | 24 999 435 |

| Water | 13 891 586 | 13 994 598 |

| Local governments | 6 136 975 | 6 449 434 |

| Transport | 4 944 732 | 4 891 024 |

| Education | 731 388 | 710 367 |

| Other | 443 294 | 402 234 |

| Total | 81 951 783 | 85 102 408 |

* General Government includes Departments (Education and Training, Housing and Public Works, State Development, Transport and Main Roads, Health and Treasury.)

Achieving sustainable access to funding

In 2017-18, QTC raised $7 billion of term debt to meet its clients’ annual funding requirements and refinance debt maturities. QTC also undertook an additional $3.5 billion pre-funding, reducing future borrowing programs. During the year, QTC issued a new 2030 benchmark bond and 2022 floating rate note to further smooth and extend its maturity profile and diversify its investor base.

QTC continued to demonstrate its reputation as a premium issuer with its investors, through the high-quality execution of term debt issuance. Using the strength of its AA+ credit rating, QTC provided the market with diverse, liquid lines that resulted in $10.5 billion being successfully raised for the Queensland Government’s current and future borrowing and refinancing requirements.

The original estimated term debt requirement for 2017-18 was $6.8 billion. This was revised up to $7 billion following the Government’s Mid-Year Fiscal and Economic Review, released in December 2017.

QTC undertook a range of activities to complete its annual borrowing program and support its bonds in the market, including:

- completing the term debt requirement of $7 billion

- prefunding $3.5 billion towards future funding requirements

- issuing $8 billion of benchmark bonds, including one new benchmark bond maturing in 2030

- issuing one new floating rate note maturing in 2022, and

- issuing $475 million into the 2047 bond, increasing this line to $505 million.

QTC maintained its focus on providing its Fixed Income Distribution Group and investor base with flexibility and transparency.

On 13 June 2018, QTC announced its indicative $8 billion term debt borrowing requirement for the 2018-19 fiscal year.

QTC’s proactive management of the borrowing program and the management of its client funding and balance sheet activities helped to smooth and extend its maturity profile and support QTC’s bond spreads. Management of QTC’s liquid assets, funding execution and balance sheet asset and liability management provided significant savings during 2017-18, while QTC’s total debt outstanding as at 30 June 2018 was approximately $89 billion.

QTC’s issuance strategy continues to support its commitment to a diverse range of funding sources to complement its core A$ benchmark bonds. This diversity has seen it utilise a variety of instruments in the past year, including bond maturities out to 30 years and a new floating rate note. Investor demand remained solid for QTC’s primary issuance, with all public issuances oversubscribed.

In 2017-18, QTC proactively managed its bond maturity profile to reduce refinancing risk by achieving more even maturities across the curve. This included reducing late 2018 and 2019 maturities by $1.6 billion to reduce refinancing risk, improve credit metrics and smooth and extend the maturity profile. The issuance of $1.75 billion in a new 2030 benchmark bond and increasing the 2047 non-benchmark bond by $475 million also contributed to smoothing and extending QTC’s maturity profile.

In May 2018, QTC released its first Green Bond Report which detailed the allocation of proceeds from its inaugural issuance. It also announced that QTC has become a programmatic issuer of Climate Bonds Initiative (CBI) certified green bonds, an increase to its eligible project pool to more than AUD4 billion and enhancements to its green bond approach. These developments increase the scope and ability for future green bond issuance to support the State Government’s focus on transitioning to a low-carbon economy.

QTC continued to focus on activities to expand its investor base, delivering an effective domestic and global investor relationship program during the year. Open and transparent communication with the market remains a focus. QTC continued to regularly engage with both its Fixed Income Distribution Group and investors through its funding and markets team.

As at 30 June 2018

QTC has a diverse range of funding facilities in a variety of markets and currencies. The majority of QTC’s funding is sourced through long-term debt facilities, with QTC’s AUD benchmark bonds being the principal source of funding.

| Overview as at 30 June 2018 | Program limit ($M) | Maturities | Currencies | |

| Short-term | Domestic T-Note | Unlimited | 7–365 days | AUD |

| Euro CP | USD10,000 | 1–364 days | Multi-currency | |

| US CP | USD10,000 | 1–270 days | USD | |

| Long-term

|

AUD Bond | Unlimited | 12 benchmark lines: 2019-2028, 2030 and 2033 | AUD |

| 2 AGG* lines: 2019-2021 | AUD | |||

| 1 QTC Green Bond: 2024 | AUD | |||

| 2 floating rate note: 2018 and 2022

1 capital indexed bond: 2030 1 AUD non-benchmark line: 2047 |

AUD | |||

| Euro MTN | USD10,000 | Any maturity subject to market regulations | Multi-currency | |

| US MTN | USD10,000 | 9 months – 30 years | Multi-currency | |

*AGG – Australian Government Guaranteed

Achieving organisational excellence

QTC is committed to maintaining high organisational standards to provide an environment where corporate goals can be achieved and organisational risks are actively monitored and addressed.

QTC’s continued focus on organisational excellence has ensured the ongoing realisation of benefits and optimised the foundation from which its core funding and advisory business is delivered. These benefits are providing employees with both the opportunity and the environment to prioritise their activities to maximise the delivery of real value to the State.

Measurable improvements have been made in the operational accuracy and efficiency of the production of client statements, implementation of enhanced system functionality, and reduction in reconciliation completion times and the need for employees to work outside business hours.

Access to secure information has been streamlined, providing a more efficient working environment, as well as improved client communication and project analytics.

QTC manages its risks within an enterprise-wide risk management framework. The framework supports the achievement of QTC’s corporate objectives by providing assurance that QTC’s risks are identified, assessed and adequately and appropriately managed.

QTC produces a risk appetite statement that sets the tone from the top for risk management and establishes clear boundaries in which QTC’s material risks should be managed.

The framework identifies key internal controls, and through periodic attestation by control owners, assurance is given to management and the Board that these controls are operating effectively.

The outcome of the 2017-18 internal audit program was positive with 12 internal audits conducted and completed successfully.

Throughout 2017–18, QTC managed its portfolio market risk exposures, including interest rate, foreign exchange and counterparty risk, within its Board-approved risk management framework. QTC continues to hold a portfolio of diverse, liquid financial securities to meet the State’s liquidity requirements, consistent with its internal and external policies.

QTC competes with the global financial industry to attract and retain its high calibre employees. Pursuant to the Queensland Treasury Corporation Act 1988, QTC employees are hired on individual contracts, with employment practices aligned to the financial markets in which it operates.

QTC’s Board regularly reviews QTC’s remuneration framework, which comprises fixed and variable remuneration. The reviews are benchmarked against remuneration data from the Financial Institutions Remuneration Group (FIRG) which provides salary survey data for the Australian finance industry. QTC’s variable remuneration framework provides an opportunity for an annual short-term incentive for eligible employees, designed to ensure market competitiveness and reward outstanding organisational, group and individual performance. The QTC Board approves the entitlement to, and the quantum of, the annual review of fixed remuneration and variable short-term incentives.

With an articulated commitment to our employees to enable ‘the best work of their careers’, key focus areas this year have been on delivering against our leadership and professional development strategies in order to strengthen organisational capability. Key initiatives have included:

- strategic workforce planning to align to our organisational vision

- targeted leadership programs across all leadership levels

- professional development and stretch project opportunities

- talent management and succession planning programs, and

- culture and diversity programs.

Enterprise and team-based development programs have been delivered with a focus on culture and team development.

An employee engagement survey conducted in early 2018 resulted in an employee engagement result of 74 per cent, which places QTC at around the 90th percentile of the benchmark data. The engagement survey metric on leadership capability demonstrated that QTC’s leaders are at the 99th percentile of the benchmark data, reflecting the success of our programs in enabling leadership growth.

QTC’s Inclusion and Diversity Strategy recognises that diversity of perspective and experience improves performance, manages risk, and improves decision-making. Under the strategy’s three priority streams of culture, disability and gender, a number of initiatives were implemented, including:

- an International Women’s Day event with a focus on employment opportunities for women in regional Queensland

- continuation of two partnerships with external organisations to provide employment opportunities for people with a disability, and

- activities to celebrate our cultural diversity and the 26 nationalities represented in QTC’s workforce.

QTC’s policies support flexible working, where flexibility will contribute to QTC achieving its corporate objectives. Flexible working arrangements in place during the reporting period included part-time work, job share, purchased annual leave, phased retirement and flexible hours of work.

QTC has a corporate health and wellbeing program (Fit 4 Work), that provides activities to promote physical and mental wellbeing. Activities for the 2017-18 financial year have included flu vaccinations, health assessments, skin checks, corporate games, healthy eating seminars, and mental health and resilience sessions.

QTC regularly reviews and updates its policies and procedures to comply with legislative changes and reflect best practice, and to ensure employees have access to avenues through which to raise concerns, including an internal grievance process.

| Full-time equivalent staff (including fixed-term employees) | 188 |

| Permanent retention rate | 85.2% |

| Permanent separation rate | 14.8% |

| Permanent average tenure | 5.9 years |

Corporate governance

QTC is committed to maintaining high standards of corporate governance to support its strong market reputation and ensure that organisational goals are met and risks are monitored and appropriately addressed. QTC’s corporate governance practices are continually reviewed and updated in line with industry guidelines and standards.

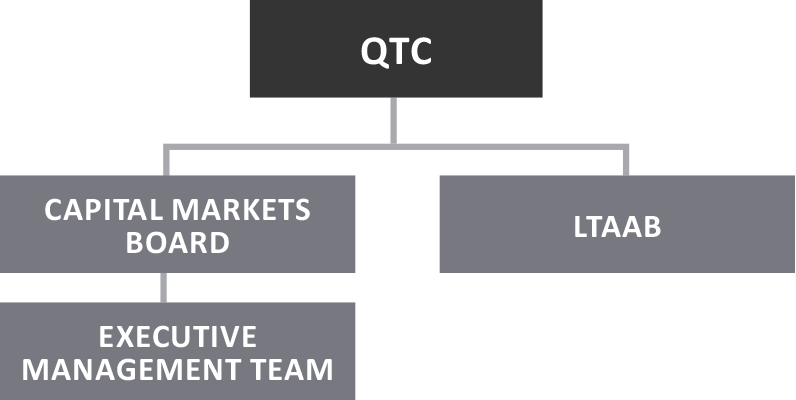

QTC was established by the Queensland Treasury Corporation Act 1988 (the QTC Act) as a corporation sole (ie, a corporation that consists solely of a nominated office holder). The Under Treasurer of Queensland is QTC’s nominated office holder. QTC has delegated its powers to its two boards:

- the Queensland Treasury Corporation Capital Markets Board (the Board), which was established in 1991 and manages all of QTC’s operations except those relating to certain superannuation and other long-term assets, and

- the Long Term Asset Advisory Board, which was established in July 2008 and advises in relation to certain superannuation and other long-term assets that were transferred to QTC from Queensland Treasury on 1 July 2008.

QTC and the Capital Markets Board have agreed the terms and administrative arrangements for the exercise of the powers that have been delegated to the Board by the Under Treasurer as QTC’s corporate sole.

The Board operates in accordance with its charter, which sets out its commitment to various corporate governance principles and standards, the roles and responsibilities of the Board and its members (based on its delegated powers), and the conduct of meetings. The charter provides that the role and functions of the Board are:

- overseeing QTC, including its control and accountability systems

- approving the strategic direction of QTC and significant corporate strategic initiatives

- approving key policies and corporate performance objectives

- setting the risk appetite within which management is expected to operate

- approving the annual budget as proposed by management

- approving financial and other reporting to the market and stakeholders

- approving the remuneration framework

- monitoring of financial, operational and corporate performance against agreed outcomes

- monitoring and measuring the performance of QTC’s management and implementation of strategy and policies, including assessing whether appropriate resources are available

- reviewing and monitoring systems of risk management and internal compliance and controls

- monitoring compliance with all relevant legal, tax and regulatory obligations

- appointing the Chief Executive, and

- overseeing executive management development and succession planning.

The Board typically holds monthly meetings (except in January, April and November) and may, whenever necessary, hold additional meetings.

Board appointments

The Board comprises members who are appointed by the Governor-in-Council, pursuant to section 10(2) of the QTC Act, with consideration given to each Board member’s qualifications, experience, skills, strategic ability and commitment to contribute to QTC’s performance and achievement of its corporate objectives. QTC’s Board is entirely constituted of non-executive directors.

Conflict of interest

Board members are required to monitor and disclose any actual or potential conflicts of interest. Unless the Board determines otherwise, a conflicted Board member may not receive any Board papers, attend any meetings or take part in any decisions relating to declared interests.

Performance and remuneration

To ensure continuous improvement and to enhance overall effectiveness, the Board conducts an annual assessment of its performance as a whole. Board members’ remuneration is determined by the Governor-in-Council (details are disclosed in QTC’s financial statements).

Board committees

The Board has established three committees, each with its own charter, to assist it in overseeing and governing various QTC activities.

Accounts and Audit Committee

The Accounts and Audit Committee has responsibility for:

- the effectiveness of internal controls surrounding key financial and operational processes

- overseeing risk and risk management (limited to those matters not undertaken by the Funding and Markets Committee, the Human Resources Committee or the Board)

- oversight of the integrity of the financial statements, and

- the adequacy and effectiveness of audit activities.

The Accounts and Audit Committee must have at least three members and meet at least four times a year.

During the year, the Accounts and Audit Committee recommended the adoption of annual financial statements, reviewed external and internal audit reports and the progress in implementing the recommendations from those reports, and reviewed the Queensland Audit Office’s Client Service Plan and QTC’s Internal Audit Plan.

QTC’s Accounts and Audit Committee has observed the terms of its charter and had due regard to the Audit Committee Guidelines.

Human Resources Committee

The Human Resources Committee has responsibility for a range of human resource matters, including:

- the appropriateness of any new or amended human resources related key policies

- the employment terms and conditions as they relate to matters of policy or an issue of significance (individual employee contract of employment)

- compliance with relevant legislation relating to human resources

- the framework for the remuneration and performance reviews

- the outcomes of review of performance and remuneration for QTC employees and QTC teams

- significant issues relating to the people environment at QTC, including the integrity and consistency of QTC’s corporate culture relative to ethical conduct and probity

- QTC’s succession plan for the executive management team and executive development and any risks associated with the adequacy of the talent pipeline

- strategic workforce planning and operational resource planning, and

- strategies to positively influence QTC’s high performance culture and risk management processes.

In addition, the Committee oversees the adequacy and effectiveness of risk management (including residual risks) relating to people and culture.

The Human Resources Committee must have at least three members and meet at least three times a year. The Human Resources Committee has observed its charter.

Funding and Markets Committee

The core responsibilities of the Funding and Markets Committee are to assist the Board in fulfilling its corporate governance responsibilities in regard to the performance and risk management of QTC’s funding and markets activities. This includes making recommendations about:

- policy framework to enhance the risk and performance outcomes achieved in the management of QTC’s funding and markets risks, and

- the effectiveness of management of QTC’s funding and market activities within the policy framework and alignment with QTC’s risk appetite.

QTC’s funding and market activities reviewed and assessed by the Committee include:

- QTC’s ability to access suitable funding markets to meet the State’s borrowing requirements and maintain appropriate levels of liquidity

- the adequacy and appropriateness of QTC’s Financial Markets Risk Policy

- whether the risk appetite in the funding and markets area is appropriate and whether QTC’s policies are consistent with the Board’s approved risk appetite while still achieving appropriate performance

- liquidity pool performance

- Cash Fund and Asset and Liability Management portfolio performance, and

- operational risk of QTC’s funding and market activities.

The Committee must have at least three members and meet at least four times a year. The Funding and Markets Committee has observed its charter.

Meetings held

| Board | Accounts & Audit Committee |

Funding & Markets Committee | Human Resources Committee |

|

| Ordinary meetings held | 9 | 5 | 4 | 4 |

| Gerard Bradley | 9 | 1 | 4 | 4 |

| Warwick Agnew* | 8 | 5 | – | – |

| Tonianne Dwyer | 9 | – | – | 4 |

| Anne Parkin | 9 | 4 | – | 4 |

| Stephen Roberts^ | 6 | – | 3 | – |

| Jim Stening | 9 | – | 3 | – |

| Karen Smith-Pomeroy | 8 | 5 | – | – |

^ Mr Roberts resigned from the Board on 1 June 2018.

* Mr Agnew resigned from the Board on 25 May 2018.

Board members are appointed by the Governor-in-Council, pursuant to section 10(2) of the Queensland Treasury Corporation Act 1988 on the recommendation of the Treasurer and in consultation with the Under Treasurer. Members are chosen on their ability and commitment to contribute to QTC’s performance and achievement of its stated objectives.

| Gerard Bradley

BCOM, DIPADVACC, FCA, FCPA, FAICD, FIML Chair Board Committees

|

Gerard Bradley was the Under Treasurer and Under Secretary of the Queensland Treasury Department from 1998 to 2012, prior to his appointment as the Chair of QTC’s Board. He was also a QTC Board member from 2000-2007.

Mr Bradley has extensive experience in public sector finance gained in both the Queensland and South Australian treasury departments. He was Under Treasurer of the South Australian Department of Treasury and Finance from 1996 to 1998, and of Queensland’s Treasury Department from 1995 to 1996. Mr Bradley held various positions in Queensland Treasury from 1976 to 1995, with responsibility for the preparation and management of the State Budget and the fiscal and economic development of Queensland. He is currently a Non-Executive Director and Chairman of Queensland Treasury Holdings Pty Ltd and related companies, and a Non-Executive Director of Star Entertainment Group Ltd, Pinnacle Investment Management Group Limited and the Winston Churchill Memorial Trust |

| Warwick Agnew

BEcon, MSocSc (Econ), MAppFin Graduate of Australian Institute of Company Directors Appointed 13 November 2014 Board Committee

|

Warwick Agnew was Queensland Treasury’s Deputy Under Treasurer, Agency Performance and Investment, previously holding the positions of Deputy Under Treasurer, Commercial Advisory and prior the department’s Chief Operating Officer. Throughout his career, Mr Agnew has held senior leadership positions across both public and private sector organisations including roles with Queensland Treasury and Trade, Queensland Treasury Corporation and ASX-listed entities, Macquarie Capital and Transfield Services.

Mr Agnew resigned from the Board on 25 May 2018. |

| Tonianne Dwyer

BJuris (Hons), LLB (Hons), GAICD Appointed 14 February 2013 with tenure to 30 June 2020 Board Committee

|

Tonianne Dwyer is a lawyer by profession, with a career of more than 25 years in international investment banking and finance in both executive management and board positions.

Ms Dwyer’s executive experience covered a broad range of sectors, including real estate investment and development, financial services, health and aged care, education, research and development, and media. She held senior roles with Hambros Bank Limited, Societe Generale and Quintain Estates & Development PLC including a role with the finance division of the UK Department of Health. Over her executive career she had experience in the UK, Europe and Wall Street. Ms Dwyer currently holds directorships with Metcash Limited, DEXUS Property Group, DEXUS Wholesale Property Fund, ALS Limited and Oz Minerals Limited. She is also a Senator and Deputy Chancellor of the University of Queensland and a Director of Chief Executive Women Limited. |

| Anne Parkin

B Science (Hons), Dip. Ed, Grad Dip. SEC, MBA, MAICD, F FIN Appointed 1 July 2016 with tenure to 30 June 2019 Board Committees

|

Anne Parkin has more than 25 years’ of international management and board level experience across Asia-Pacific banking and financial services.

Ms Parkin has held diverse leadership roles in domestic and global broking and banking, superannuation administration, retail management and education, in both the public and private sectors. At an executive level, Ms Parkin has experience operating in highly regulated businesses including banking with Credit Suisse, UBS, and in Ms Parkin is Chairman of Eco Fuels Innovations and previously, was a Non-Executive Director of both Credit Suisse Securities in Malaysia and the Philippines. As an Executive Director, she was a member of the Hong Kong Control Committee responsible for oversight of operational risk for Credit Suisse Hong Kong and its affiliates, while as Operations Executive, she was accountable for operational matters with local regulators including the Hong Kong Monetary Authority and Hong Kong Securities & Futures Commission. In recognition of her expertise in the Asia-Pacific, Ms Parkin was invited to participate in the Asia Securities Industry & Financial Markets Association (ASIFMA). |

| Stephen Roberts

BEcon Appointed 8 June 2017 Board Committee

|

Stephen Roberts has extensive investment banking, leadership and governance expertise, developed across his career in the global financial markets. He is the former Chief Executive and Chief Country Officer of Citigroup Australia, where he was responsible for the Citi franchise in Australia and New Zealand. Prior to that, Mr Roberts was the Managing Director, Institutional Business, Citigroup Australia, and held senior roles with Salomon Brothers/Citigroup Hong Kong, Lehman Brothers in Hong Kong, Salomon Brothers in London, Melbourne, Sydney and New York.

Mr Roberts resigned from the Board on 1 June 2018. |

| Karen Smith-Pomeroy

ADip (Accounting), GAICD, FIPA, FFIN Appointed 9 July 2015 with tenure to 8 July 2019 Board Committee

|

Karen Smith-Pomeroy is an experienced financial services senior executive with a specialty in risk and governance. Ms Smith-Pomeroy held senior executive roles with Suncorp Group Limited from 1997 to 2014, including Chief Risk Officer Suncorp Bank from 2009 to 2013, and Executive Director, Suncorp Group subsidiary entities from 2009 to 2014. She has also held positions on a number of Boards including CS Energy Limited and Tarong Energy Corporation Limited.

Ms Smith-Pomeroy is a Non-Executive Director of National Affordable Housing Consortium Limited, Stanwell Corporation Limited, InFocus Wealth Management Limited and Kina Securities Limited. She is a Queensland Advisory Board member of Australian Super and is also an Independent Audit Committee member of the Queensland Department of Local Government, Racing and Multicultural Affairs and South Bank Corporation. |

| Jim Stening

DipFinServ, FAICD Appointed 13 November 2014 with tenure to 30 June 2020 Board Committee

|

Jim Stening has more than 30 years’ experience in financial markets in the fixed income asset class, including hands-on trading and investing in Australian and global capital markets. Mr Stening has extensive experience in debt markets, business development, executive management and corporate governance across a diverse range of economic cycles. He has held senior roles at NAB, Merrill Lynch and Banco Santander.

Mr Stening is the founder and Managing Director of FIIG Securities Limited, Australia’s largest specialist fixed-income firm and a Non-Executive Director of related companies, Chairman of Ozfish Unlimited Limited, and a Fellow of the Australian Institute of Company Directors. |

The Long Term Asset Advisory Board (LTAAB) is responsible for managing the reserves set aside for future government liabilities (such as superannuation and insurance).

The LTAAB has power delegated from QTC to:

- manage the sufficiency of the funding of superannuation and insurance liabilities

- set investment objectives and strategies for the assets held to meet those liabilities

- determine the most appropriate investment structure, and

- monitor investment performance.

The LTAAB holds meetings at least four times per year and held four meetings in the year under review.

The LTAAB members are appointed by the Governor-in-Council, pursuant to section 10(2) of the QTC Act.

The members of LTAAB are:

| Name | Position |

| Jim Murphy, Under Treasurer | Chairperson |

| Philip Noble, Chief Executive, QTC | Member |

| Wayne Cannon, State Actuary | Member |

| Alison Rayner, Deputy Under Treasurer (Economic and Fiscal) | Member |

| Warwick Agnew*, Deputy Under Treasurer (Agency Performance and Investment) | Member |

* Mr Agnew resigned from the Board on 25 May 2018.

The LTAAB has observed its charter.

In accordance with the provisions of the Auditor-General Act 2009, the Queensland Audit Office is the external auditor for QTC. The Queensland Audit Office has the responsibility for providing Queensland’s Parliament with assurances as to the adequacy of QTC’s discharge of its financial and administrative obligations.

The Financial and Performance Management Standard 2009 (Qld) (Standard) governs the operation of QTC’s internal audit function. QTC outsourced its independent internal audit function to Ernst and Young (EY) for the 2017-18 financial year. Internal audit reports to the Accounts and Audit Committee and is conducted under an Internal Audit Policy, consistent with the relevant audit and ethical standards. The role of internal audit is to support QTC’s corporate governance framework by providing the Board (through the Accounts and Audit Committee) with:

- assurance that QTC has effective, efficient and economical internal controls in place to support the achievement of its objectives, including the management of risk, and

- advice with respect to QTC’s internal controls and business processes.

Internal audit is responsible for:

- developing an annual audit plan, based on the assessment of financial and business risks aligned with QTC’s strategic goals and objectives, as well as material risks, and approved by the Accounts and Audit Committee

- providing regular audit reports and periodic program management reports to the management team and the Accounts and Audit Committee, and

- working constructively with QTC’s management team to challenge and improve established and proposed practices and to put forward ideas for process improvement.

In the year under review, EY completed its internal audits in accordance with the approved annual audit plan.

QTC has had due regard to Treasury’s Audit Committee guidelines, in establishing and supervising its outsourced internal audit function and, together with the Accounts and Audit Committee, in overseeing and monitoring the internal audit function.

The responsibility for the day-to-day operation and administration of QTC is delegated by the Board to the Chief Executive and the Executive Management Team. The Chief Executive is appointed by the Board. Executives are appointed by the Chief Executive. As with the Board, all Executive Management Team appointments are made on the basis of qualifications, experience, skills, strategic ability, and commitment to contribute to QTC’s performance and achievement of its corporate objectives.

QTC’s Executive Management Team as at 30 June 2018

| Philip Noble | Chief Executive |

| Grant Bush | Deputy Chief Executive and Managing Director, Funding and Markets |

| Mark Girard | Managing Director, Client Advisory |

| Rupert Haywood | Managing Director, Risk and Financial Operations |

| Jane Keating | Managing Director, Corporate Services |

.

.

Financial Statements

Financial Statements for the 2017-18 Financial Year (Download pdf, 1,323Kb)

The foregoing general purpose financial statements have been prepared in accordance with the Financial Accountability Act 2009 and other prescribed requirements.

The Directors draw attention to note 2(a) to the financial statements, which includes a statement of compliance with International Financial Reporting Standards.

We certify that in our opinion:

(i) the prescribed requirements for establishing and keeping the accounts have been complied with in all material respects, and

(ii) the foregoing annual financial statements have been drawn up so as to present a true and fair view of Queensland Treasury Corporation’s assets and liabilities, financial position and financial performance for the year ended 30 June 2018.

The financial statements are authorised for issue on the date of signing this certificate which is signed in accordance with a resolution of the Capital Markets Board.

G P Bradley

Chairman

P C Noble

Chief Executive

Brisbane 28 August 2017

Independent Auditor's report

Independent-Auditor’s-Report for the 2017-18 Financial Year (Download pdf, 1,323Kb)

Appendices

QTC is required to make various disclosures in its Annual Report. QTC is also required to make various disclosures on the Queensland Government’s Open Data website (qld.gov.au/data) in lieu of inclusion in its Annual Report. This Appendix sets out those mandatory disclosure statements that are not included elsewhere in the report or made available on the Open Data website.

Information systems and record keeping

During the year, QTC continued its compliance with the provisions of the Public Records Act 2002, and its implementation of the Information Standard 40: Recordkeeping and Information Standard 31: Retention and Disposal of Public Records.

QTC has continued its work with State Archives on the development of a QTC-specific Local Retention and Disposal Schedule, and provides training to staff in the appropriate management of public records in all formats, including email.

During the year, QTC continued to enhance its electronic document management system for improved information management and storage cost reduction.

Public Sector Ethics Act

QTC provides the following information pursuant to obligations under section 23 of the Public Sector Ethics Act 1994 (Qld) to report on action taken to comply with certain sections of the Act.

QTC employees are required to comply with QTC’s Code of Conduct for employees, which aligns with the ethics principles and values in the Public Sector Ethics Act 1994 (Qld), as well as the Code of Conduct established by the Australian Financial Markets Association of which QTC is a member. Both codes are available to employees via QTC’s intranet. A copy of QTC’s Code of Conduct can be inspected by contacting QTC’s Human Resources Group (see Appendix E for contact details). Appropriate education and training about the Code of Conduct has been provided to QTC staff.

QTC’s human resource management and corporate governance policies and practices ensure that QTC:

- acts ethically with regard to its Code of Conduct and within appropriate law, policy and convention, and

- addresses the systems and processes necessary for the proper direction and management of its business and affairs.

QTC is committed to:

- observing high standards of integrity and fair-dealing in the conduct of its business, and

- acting with due care, diligence and skill.

QTC’s Compliance Policy requires that QTC and all employees comply with the letter and the spirit of all relevant laws and regulations, industry standards, and relevant government policies, as well as QTC’s own policies and procedures.

Remuneration: Board and Committee

For the year ending 30 June 2018, the remuneration and committee fees of the QTC Capital Market Board members (excluding superannuation contributions and non-monetary benefits) were as follows:

| Board | Committee | |||

| Chairperson | $100,527 | Chairperson | $6,658 | |

| Member | $33,551 | Member | $5,152 |

The total remuneration payments made to the members of the QTC Capital Market Board was $331,330 and the total on-costs (including travel, accommodation, and hiring of motor vehicles for the members) was $29,897.

No payments in relation to remuneration or on-costs (including travel, accommodation, and hiring of motor vehicles for the members) were made to members of the Long Term Asset Advisory Board in the year ending 30 June 2018.

Related entities

The related entities in Note 23 are not equity accounted in the financial report of the Queensland Treasury Corporation. These entities are consolidated into Queensland Treasury’s financial report.

Australian Government Guarantee (AGG): Also known as the Commonwealth Government Guarantee. In response to the global financial crisis, on 25 March 2009, the Australian Government provided a time-limited, voluntary guarantee over existing and new Australian state and territory government borrowing. On 16 June 2009, the Queensland Government took up the guarantee on all existing QTC AUD denominated benchmark bond lines (global and domestic) with a maturity date of between 12 months and 180 months (1-15 years). The RBA approved QTC’s application on 11 December 2009. The AGG was withdrawn for new borrowings after 31 December 2010.

Basis point: One hundredth of one per cent (0.01 per cent).

Bond: A financial instrument where the borrower agrees to pay the investor a rate of interest for a fixed period of time. A typical bond will involve regular interest payments and a return of principal at maturity.

Commonwealth Government Guarantee (CGG): See Australian Government Guarantee above.

CP (commercial paper): A short-term money market instrument issued at a discount with the full face value repaid at maturity. CP can be issued in various currencies with a term to maturity of less than one year.

Credit rating: Measures a borrower’s creditworthiness and provides an international framework for comparing the credit quality of issuers and rated debt securities. Rating agencies allocate three kinds of ratings: issuer credit ratings, long-term debt and short-term debt. Issuer credit ratings are among the most widely watched. They measure the creditworthiness of the borrower including its capacity and willingness to meet financial obligations. QTC has a strong rating from two rating agencies—Standard & Poor’s, and Moody’s.

Fixed Income Distribution Group: A group of financial intermediaries who market and make prices in QTC’s debt instruments.

Floating rate notes (FRNs): A debt instrument which pays a variable rate of interest (coupon) at specified dates over the term of the debt, as well as repaying the principal of the maturity date. The floating rate is usually a money market reference rate, such as BBSW, plus a fixed margin. Typically the interest is paid quarterly or monthly.

GOC: Government-owned Corporation.

Green Bond: QTC Green Bonds are guaranteed by the Queensland State Government, issued under the AUD Bond Program with 144A capability and certified by the Climate Bonds Initiative. Proceeds from QTC Green Bonds are to be used to fund qualifying green projects and assets for the State of Queensland. The proceeds are allocated to specific projects that support Queensland’s transition to a low-carbon and climate resilient economy. The qualifying green projects and QTC’s Green Bond Framework have been certified by the Climate Bonds Initiative and verified by DNV GL, an approved third-party assurance provider.

Issue price: The price at which a new security is issued in the primary market.

Liquid: Markets or instruments are described as being liquid, and having depth, if there are enough buyers and sellers to absorb sudden shifts in supply and demand without price distortions.

Market value: The price at which an instrument can be purchased or sold in the current market.

MTN (Medium-Term Note): A financial debt instrument that can be structured to meet an investor’s requirements in regards to interest rate basis, currency and maturity. MTNs usually have maturities between 9 months and 30 years.

QTC: Queensland Treasury Corporation.

RBA: Reserve Bank of Australia.

T-Note (Treasury Note): A short-term money market instrument issued at a discount with the full face value repaid at maturity. T-Notes are issued in Australian dollars with a term to maturity of less than 1 year.

Note: This checklist excludes reference to any requirements that do not apply to QTC for the current reporting period.

FAA: Financial Accountability Act 2009; FPMS: Financial and Performance Management Standard 2009; ARRs: Annual report requirements for Queensland Government agencies

| Summary of requirement | Basis for requirement | Annual report reference | |

| Letter of compliance | A letter of compliance from the accountable officer or statutory body to the relevant Minister/s | ARRs – section 7 | Page 1 |

| Accessibility | Table of contents

Glossary |

ARRs – section 9.1 | Inside front cover

Appendix B |

| Public availability | ARRs – section 9.2 | Appendix D | |

| Interpreter service statement | Queensland Government Language Services Policy

ARRs – section 9.3 |

Appendix D | |

| Copyright notice | Copyright Act 1968

ARRs – section 9.4 |

Back cover | |

| General information | Introductory information | ARRs – section 10.1 | Page 2-5 |

| Agency role and main functions | ARRs – section 10.2 | Page 2-3 | |

| Operating environment | ARRs – section 10.3 | Pages 3-13, 16 | |

| Non-financial performance | Government’s objectives for the community | ARRs – section 11.1 | Pages 6-11 |

| Agency objectives and performance indicators | ARRs – section 11.3 | Pages 4-11 | |

| Financial performance | Summary of financial performance | ARRs – section 12.1 | Pages 4-5, Notes to Financial Statements: Pages 17-49 |

| Governance – management and structure | Organisational structure | ARRs – section 13.1 | Pages 12-16 |

| Executive management | ARRs – section 13.2 | Page 4 -5, 14-16 | |

| Public Sector Ethics Act 1994 | Public Sector Ethics Act 1994

ARRs – section 13.4 |

Appendix A | |

| Governance – risk management and accountability | Risk management | ARRs – section 14.1 | Page 10 |

| Audit committee | ARRs – section 14.2 | Pages 12-13, 56 | |

| Internal audit | ARRs – section 14.3 | Page 16 | |

| Information systems and recordkeeping | ARRs – section 14.5 | Appendix A | |

| Governance – human resources | Strategic workforce planning and performance | ARRs – section 15.1 | Pages 10-11 |

| Open Data | Consultancies | ARRs – section 33.1 | Appendix A |

| Overseas travel | ARRs – section 33.2 | Appendix A | |

| Queensland Language Services Policy | ARRs – section 33.3 | Appendix A | |

| Financial statements | Certification of financial statements | FAA – section 62

FPMS – sections 42, 43 and 50 ARRs – section 17.1 |

Page 50 |

| Independent Auditor’s Report | FAA – section 62

FPMS – section 50 ARRs – section 17.2 |

Pages 51-54 |

Queensland Treasury Corporation

Level 31, 111 Eagle Street

Brisbane Queensland Australia

GPO Box 1096

Brisbane Queensland Australia 4001

Telephone: +61 7 3842 4600

Facsimile: +61 7 3221 4122

Email: enquiry@qtc.com.au

Internet: www.qtc.com.au

Queensland Treasury Corporation’s annual reports (ISSN 1837-1256 print; ISSN 1837-1264 online) are available on QTC’s website at www.qtc.com.au/about-qtc/annual-reports. If you would like a copy of a report posted to you, please call QTC’s reception on +61 7 3842 4600.

If you would like to comment on a report, please complete the online enquiry form located on our website.

| Telephone | |

| Queensland Treasury Corporation (Reception) | +61 7 3842 4600 |

| Stock Registry (Link Market Services Ltd) | 1800 777 166 |

![]()

QTC is committed to providing accessible services to Queensland residents from culturally and linguistically diverse backgrounds. If you have difficulty understanding this report, please contact QTC’s reception on +61 7 3842 4600 and we will arrange for an interpreter to assist you.

Download QTC’s dealer panels (as at 30 June 2018)

Download QTC’s issuing and paying agents

Information for institutional investors

Core to its key funding principles, QTC is committed to being open and transparent with investors and its partners in the financial markets.

Through its website, QTC provides a range of information for investors on its various funding facilities and annual borrowing program. The website also provides information and links about Australia and Queensland to help investors gain a better understanding of:

- the different levels of government in Australia

- the forms of fiscal support the Australian Government provides to the states and territories

- relevant governance practices, legislation and polices

- financial data and budget information, and

- economic and trade data.

QTC also offers investors the ability to subscribe to quarterly funding updates.

Website: qtc.qld.gov.au/institutional-investors

Quarterly investor updates: Subscribe from the institutional investor section of the website

Bloomberg ticker: qtc

Availability of annual reports

QTC’s annual reports (ISSN 1837-1256) are available on QTC’s website for the past five financial years, earlier years are available by request. Printed copies can also be provided; please contact us for further information.

Feedback

We are committed to continually improving our Annual Report. Your feedback on QTC’s Annual Report, including presentation, ease of navigation, value of information, style of language, level of detail and suggestions for improvement, can be provided via our online enquiry form.

Disclaimer

The materials presented on this site are provided by the Queensland Treasury Corporation for information purposes only. Users should note that the electronic versions of the Annual Report on this site are not recognised as the official or authorised version. The official copy of the Annual Report, as tabled in the Legislative Assembly of Queensland, can be accessed from the Queensland Parliament tabled papers website database.